How Polimec disrupts fundraising with Polkadot

Polimec leverages Polkadot to disrupt capital fundraising, improving compliance, security, and cross-chain interoperability for web3 startups.

By Polkadot•October 31, 2024

By Polkadot•October 31, 2024

Polimec plans to onboard key financial intermediaries by Q1 2025

Polimec is a blockchain-based financial settlement layer designed to streamline the capital-raising process for web3 startups. By enabling wallet-free investments through integrations with financial intermediaries like crypto brokers, exchanges, and banks, Polimec facilitates compliant, trustless transactions, making it easier for users to invest in early-stage projects without directly interacting with blockchain technology.

Challenge: Navigating security, multichain complexity and compliance

As Polimec developed its capital-raising platform, the team faced two fundamental challenges. The first relates to regulatory compliance and security—the platform needed a robust system to handle high-value transactions across multiple blockchain networks while meeting regulatory requirements in different jurisdictions.

The second challenge lies in Polimec's core mission of making web3 fundraising more accessible. Polimec prioritized an intuitive, wallet-free interface that simplifies user participation for those unfamiliar with crypto and blockchain, all without compromising security. Operating across multiple blockchains presented unique technical needs, necessitating a solution capable of efficiently managing cross-chain liquidity and aggregating funds from both traditional and decentralized sources to reduce market fragmentation.

Solution: Harnessing the Polkadot’s shared security and modularity

Polimec turned to Polkadot for its unique shared security model, provided by the Polkadot Chain, and its modular, customizable architecture through the Polkadot SDK—both critical to addressing Polimec's operational challenges. By integrating with Polkadot, Polimec could:

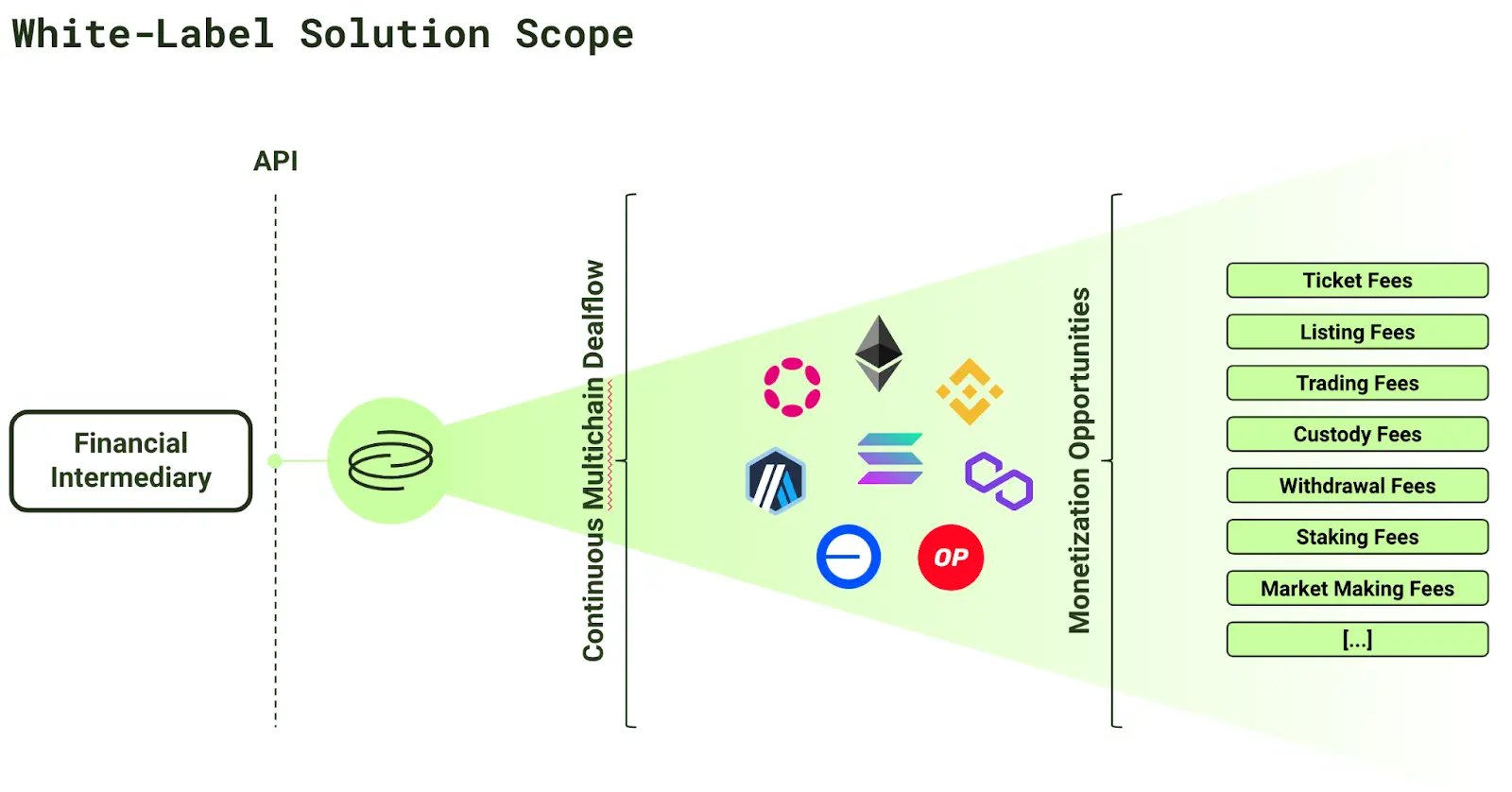

- Aggregate liquidity from various financial intermediaries and integrate seamlessly with multiple blockchains, providing a unified platform for capital raising across ecosystems like Ethereum, Solana, and Avalanche.

- Guarantee security through Polkadot’s shared security, which provides an extra layer of trust for transactions.

- Enable cross-chain compatibility, streamlining liquidity flows and capital access, reducing inefficiencies, and making multichain investments seamless for users and startups.

The collaborative and innovation-driven nature of the Polkadot ecosystem also proved instrumental for Polimec. Drawing from the collective expertise of various teams within the network, Polimec was able to refine their solution and innovate quickly.

Results and impact

Since launching its PLMC token, Polimec has streamlined capital-raising for startups, attracting institutional investors and enhancing deal flow. Polimec’s wallet-free investment experience is expected to expand its user base, driving regulatory-compliant transactions across ecosystems.

What’s next

Looking ahead, Polimec plans to onboard key financial intermediaries by Q1 2025, enabling Polimec to offer primary market deals to their clients. Polimec’s upcoming web2-native white-label solution will further simplify user interactions by eliminating the need for wallets on the investor side. This feature enables financial intermediaries to offer compliant private sales to clients, expanding reach to new markets.

The platform is also preparing to launch a one-token model, allowing users to tap into assets like USDC, USDT, and DOT. Additionally, with Banxa’s on-ramp integration, Polimec continues simplifying the user experience, making blockchain-based fundraising accessible to more users. By building with Polkadot’s modular SDK, Polimec ensures native interoperability and security from the outset. This foundation allows the platform to focus on reshaping the future of fundraising, providing users with a secure and compliant gateway into early-stage web3 ventures.

“We started with Polkadot because of the leading tech stack and the shared security model. With Polkadot, we can settle transactions securely while offering funding rounds on multiple chains like Ethereum and Solana. For investors, the focus is on economic security, and Polkadot delivers that.”