How Centrifuge built a $661M+ real-world assets infrastructure on Polkadot

Centrifuge revolutionized real-world asset tokenization by bringing offchain assets onchain. Learn how Polkadot’s modular infrastructure enabled scalability, interoperability, and innovation in decentralized finance.

By Polkadot•January 8, 2025

By Polkadot•January 8, 2025

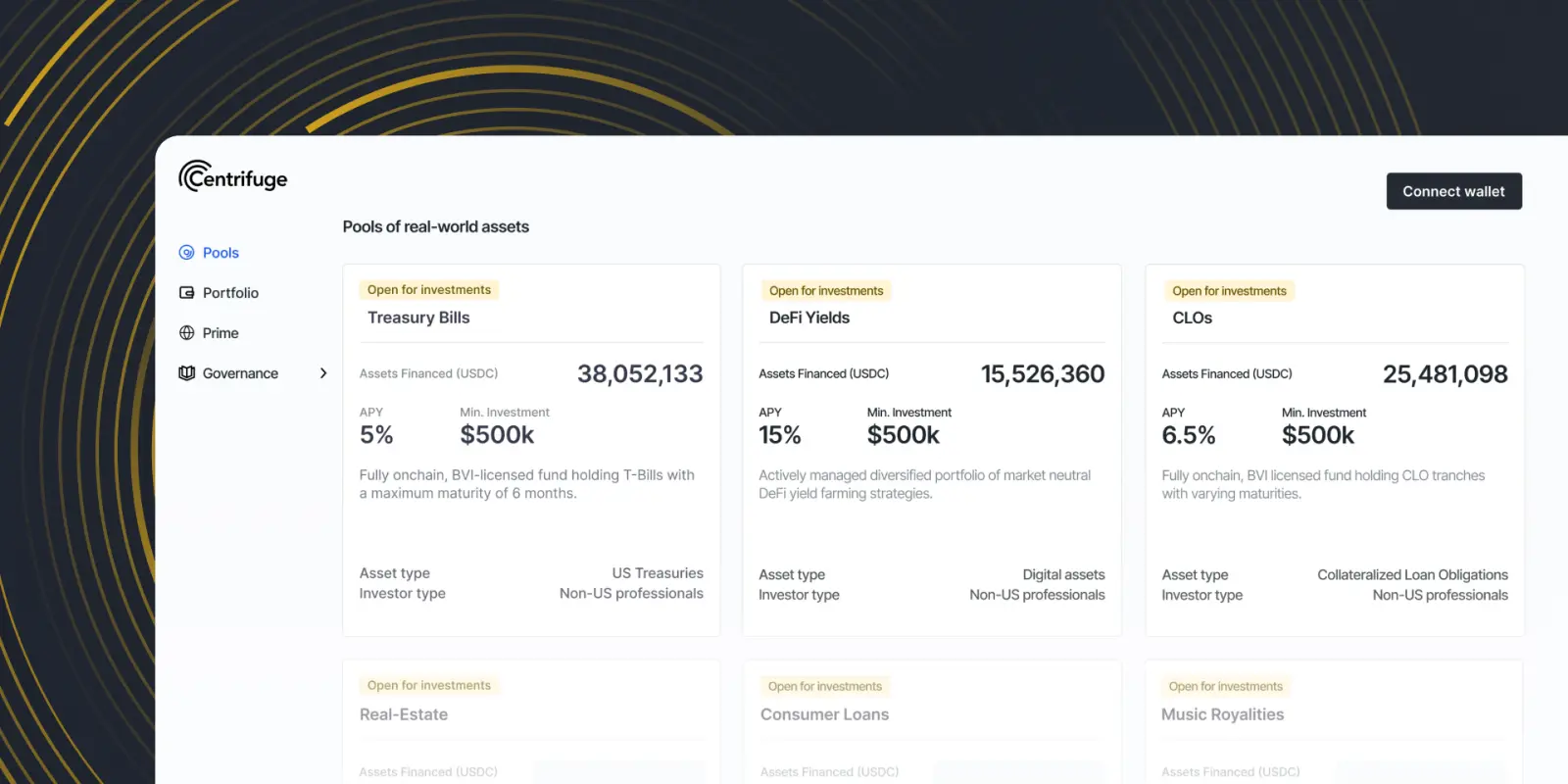

Over $661 million in assets financed as of December 2024

Centrifuge is a pioneering tokenization protocol founded in 2017, recognized for coining the term “real-world assets” (RWAs). As an issuer-, jurisdiction-, and asset-agnostic protocol, Centrifuge seamlessly integrates offchain assets into the onchain real-world asset decentralized finance (DeFi) ecosystem.

Governed and operated by the Centrifuge DAO through CFG tokenholders, the open-source protocol has financed over $661 million in assets as of December 2024, establishing itself as the leading platform for tokenizing and managing real-world assets.

Challenge: The scalability barrier in real-world asset tokenization

When Centrifuge launched its platform in 2020, it faced the complex challenge of transforming traditional financial processes that had remained largely unchanged for decades. Existing systems relied heavily on paper contracts, manual accounting, and slow settlement processes, creating significant inefficiencies in asset management.

As Centrifuge set out to tokenize RWAs, the absence of blockchain infrastructure to support offchain assets became apparent. At the time, the ecosystem consisted largely of cryptocurrencies like Bitcoin and Ethereum alongside basic DeFi products. Addressing this meant Centrifuge had to establish entirely new technical and operational standards while solving complex technical challenges around scalability and computation. The platform needed to handle intensive calculations for portfolio creation, fees, and settlements while remaining cost-effective and user-friendly across multiple blockchains.

These demands required an infrastructure that could scale effectively while also providing native cross-chain compatibility and robust security—capabilities that would ultimately lead Centrifuge to Polkadot's unique architecture.

Solution: Real-world assets at scale

Polkadot’s interoperable infrastructure became the foundation for Centrifuge’s RWA tokenization platform. Polkadot’s modular architecture enabled Centrifuge to perform complex computations like portfolio creation, fee calculations, and instant settlements. This cost-effective environment maintained cross-chain accessibility through Polkadot's cross-consensus messaging (XCM), allowing asset managers to conduct operations on Centrifuge's blockchain while investors interacted natively across networks like Ethereum and Arbitrum.

Polkadot's shared security model eliminated the need for an independent validator set while ensuring efficient scaling without compromising safety. By handling back-end computation on Polkadot while maintaining cross-chain accessibility, the platform delivered both robust security through the Polkadot Chain and low transaction fees.

Centrifuge also utilized Polkadot's transparent, decentralized governance framework, OpenGov, which aligned perfectly with their DAO-based operational model. The successful passage of referendum #1122 for 3 million USDC demonstrated the effectiveness of this governance approach, further strengthening the platform’s unified user experience.

Results and impact

Since implementing on Polkadot, Centrifuge has facilitated an impressive $661 million* in total assets financed. A landmark $220 million fund launch with BlockTower Credit and MakerDAO demonstrated strong institutional appetite for RWAs, while a strategic $1 million pilot investment from the Web3 Foundation reinforced growing market confidence in tokenized real-world assets. Through Anemoy Liquid Treasury Fund, Centrifuge exemplifies the seamless bridge between traditional and decentralized finance. By offering tokenized access to U.S. Treasury Bills, they provide opportunities that appeal to both crypto-native and institutional investors alike.

The impact extends well beyond Centrifuge's platform metrics. The team, including co-founder Lucas Vogelsang, has actively contributed to the broader Polkadot ecosystem through initiatives like Velocity Labs, helping drive DeFi infrastructure development forward. Their successful navigation of governance processes and deep ecosystem engagement have set new standards for how projects can integrate with and strengthen the community.

What’s next

Looking ahead, Centrifuge plans to deepen collaborations with asset managers and institutional investors to make RWAs more accessible, scalable, and transparent. Three key trends drive Centrifuge's strategic direction. First, they anticipate deeper convergence between blockchain infrastructure providers and traditional asset managers, creating unified financial systems that leverage the strengths of both worlds. Through their partnerships with established players like BlockTower Credit and Janus Henderson, Centrifuge is already laying the groundwork for this integration.

Second, as blockchain technology matures, Centrifuge expects the boundaries between traditional and tokenized funds to dissolve. Platform development will continue to focus on making digital assets as familiar and accessible as conventional financial products, making RWAs more accessible to mainstream investors.

Third, Centrifuge foresees advanced technology reducing manual oversight by enabling automated portfolio management with real-time optimization of yield, risk, and liquidity across investor classes. Centrifuge’s roadmap, combined with strategic partnerships, and continued innovation in RWAs, points toward a future where blockchain-based financial products will become an integral part of the global financial system.

"Polkadot provided the architecture we needed to scale real-world asset tokenization for institutional use. By enabling cost-effective operations, seamless interoperability, and shared security, we’ve bridged the gap between traditional finance and blockchain, creating scalable opportunities for asset managers and investors alike."

*Value as of December 2024