How Bifrost redefines cross-chain liquid staking

Bifrost transforms DeFi with Polkadot, unlocking secure and seamless cross-chain liquid staking opportunities.

By Polkadot•December 3, 2024

By Polkadot•December 3, 2024

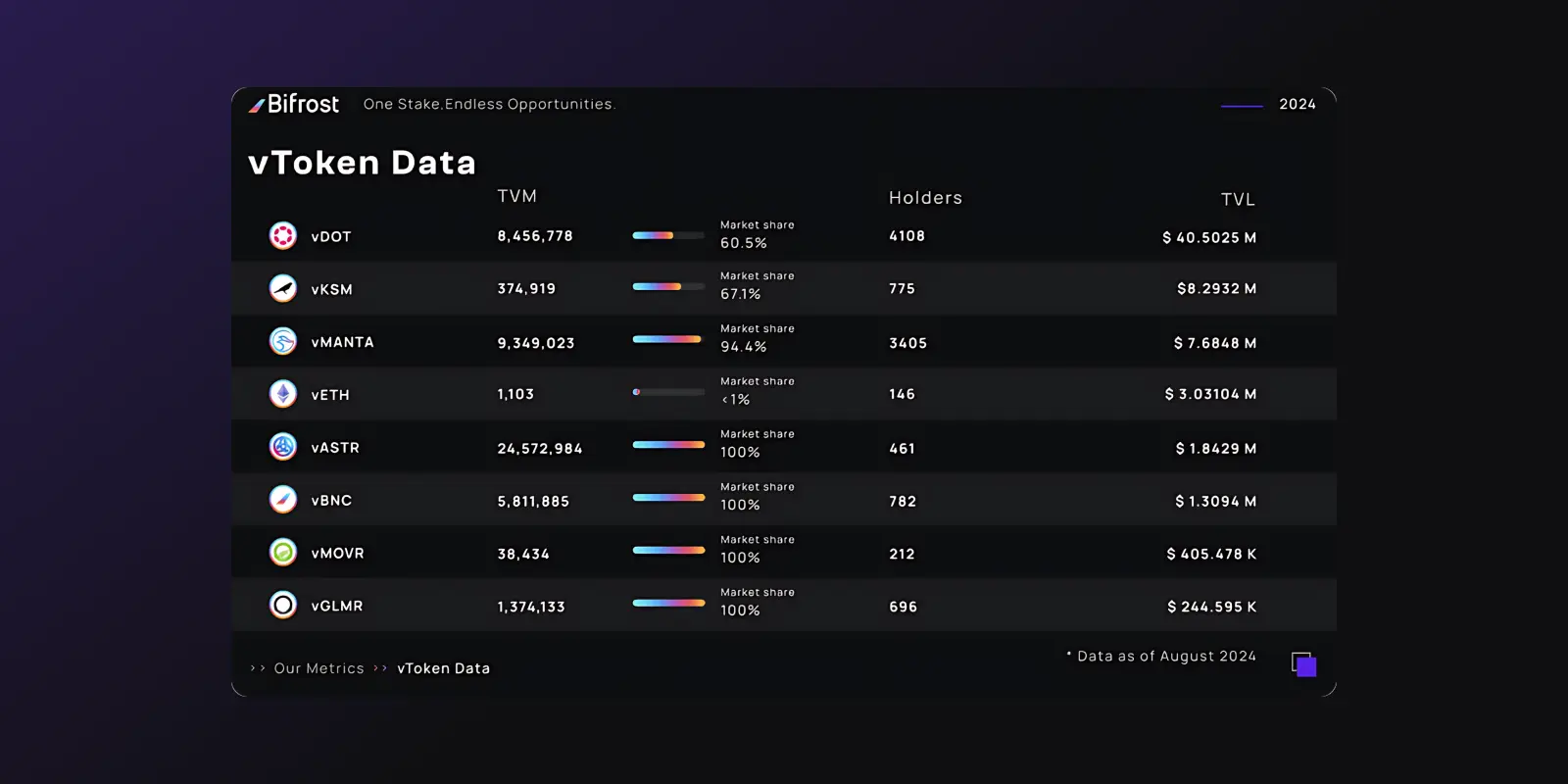

Over 2.9 million transactions processed since launch and over $120M in TVL

Bifrost is a dedicated liquid staking appchain tailored for all blockchains. By leveraging the Polkadot SDK and decentralized cross-chain interoperability, Bifrost delivers standardized cross-chain liquid staking solutions across diverse ecosystems. Bifrost empowers users to earn staking rewards and access DeFi opportunities without sacrificing liquidity or flexibility, all while benefiting from robust security and seamless cross-chain functionality.

Challenge: Security and customization limitations

While Bifrost initially launched its ETH liquid staking token, vETH, in 2020 on Ethereum mainnet, the team’s long-term vision was always centered on building a dedicated liquid staking chain on Polkadot. The limitations of Ethereum’s smart contract environment brought certain challenges into focus, such as restricted control over critical security settings, limited flexibility in optimizing transaction fees, and the inability to customize governance mechanisms or implement protocol upgrades. These constraints reinforced the need to create a sovereign blockchain that could better align with Bifrost's goals.

The lack of cross-chain interoperability and the potential risk of liquid staking token fragmentation across multiple networks further highlighted the necessity for a more cohesive and customizable framework. It became increasingly clear that remaining confined to a smart contract model would hinder Bifrost’s capacity to drive innovation and meet growing market demands.

Solution: Building a sovereign appchain on Polkadot

As part of its long-term vision, Bifrost leveraged Polkadot’s architecture to evolve from a smart contract protocol into a sovereign appchain. By using the Polkadot SDK, Bifrost developed a dedicated liquid staking chain, providing greater customization over protocol operations and eliminating the risk of fragmented liquidity by standardizing the issuance of LSTs.

Bifrost’s shift to Polkadot also enabled cross-chain interoperability via XCM, streamlining the user experience by allowing users to move their liquid staking tokens, like vDOT, across different chains. Polkadot’s shared security model was another key advantage, eliminating the need for independent validator management while reducing operational complexity and ensuring the platform could scale without compromising security measures.

Together, Polkadot’s modular architecture, built-in interoperability, and pooled security model provided Bifrost with the building blocks to achieve greater control, security, and scalability.

Results and impact

Bifrost has firmly established itself as a leader in liquid staking. Capturing 60% of the DOT LST market share, the platform now has over $125 million in total value locked (TVL)*. Transaction activity has surged, with over 2.9 million transactions and 180,000 cross-chain messages since its launch on Polkadot. Additionally, Bifrost achieved a unique milestone as the only liquid staking protocol that allows vDOT to be used in decentralized governance activities on OpenGov.

What’s next

Bifrost is charting ambitious plans to extend its liquid staking ecosystem, with a key focus on enhancing vETH’s functionality and accessibility. By early 2025, Bifrost aims to upgrade vETH, making it a native asset on Bifrost's Polkadot-based blockchain. This upgrade will allow users to mint vETH directly on Polkadot, providing a more seamless and efficient staking experience.

The platform is also working to extend vETH’s reach across Polkadot’s entire ecosystem, leveraging its SLPx protocol to make vETH interoperable with all Polkadot chains. Beyond Polkadot, Bifrost plans to expand vETH’s reach to Ethereum Layer 2 (L2) networks, starting with Base, through Hyperbridge and SPLx integrations. Support for additional Optimism-based L2 chains is planned in the near future via Hyperbridge governance. Overall, these advancements will expand access to Bifrost’s liquid staking solutions, enabling seamless liquid staking opportunities across the Polkadot and Ethereum L2 ecosystems alike.

“Polkadot’s Substrate framework gave us full control over our own blockchain, allowing us to move beyond the limitations of smart contracts and build a dedicated appchain for liquid staking. With Polkadot, we’ve created a solution that’s more scalable, secure, and customizable.”

*The TVL figure reflects DOT’s average value at the time of writing.