Chainflip powers secure and seamless cross-chain swaps without bridges

Chainflip redefines DeFi with seamless, secure cross-chain swaps, eliminating bridges and wrapped tokens to enable true interoperability across blockchains.

By Polkadot•October 31, 2024

By Polkadot•October 31, 2024

$535M+ in swap volume processed within 6 months of launching

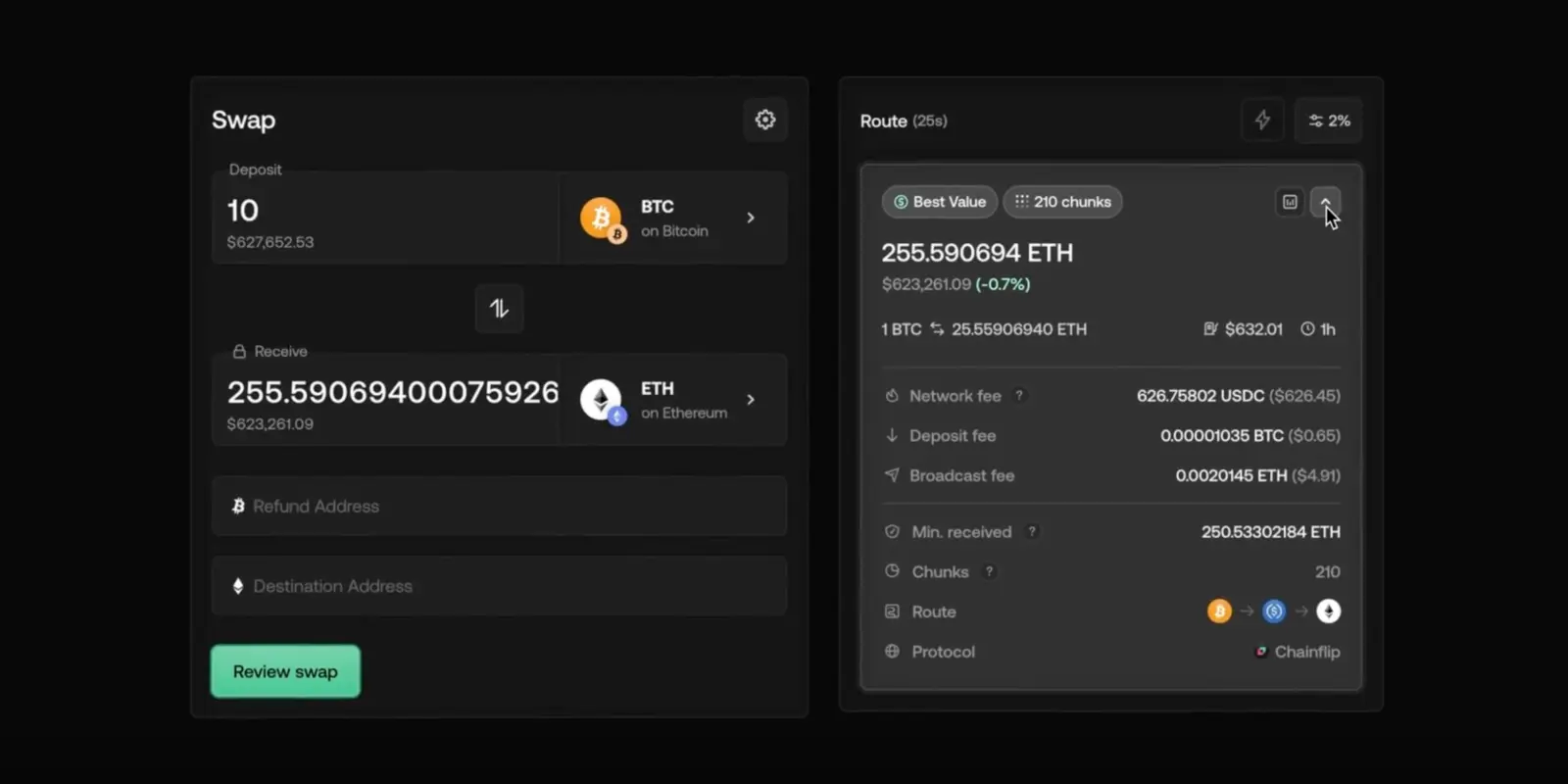

Chainflip is a decentralized exchange (DEX) focused on enabling secure, permissionless cross-chain swaps without the need for bridging or wrapped tokens. By addressing the complexities of moving native assets across blockchains like Bitcoin and Solana, Chainflip delivers an efficient, user-friendly solution to one of DeFi's most persistent challenges: true cross-chain interoperability.

Challenge: Overcoming cross-chain complexities

Cross-chain swaps, especially involving Bitcoin, have historically been inefficient and risky. Platforms often depend on bridging mechanisms or wrapped tokens, which introduce vulnerabilities such as hacks and liquidity constraints. Additionally, Bitcoin’s lack of smart contract functionality and slower transaction speeds make it difficult to perform seamless decentralized swaps, especially for high-value assets. To tackle these DeFi hurdles, Chainflip needed a scalable infrastructure capable of supporting the growing demand for native asset swaps across diverse blockchains without compromising decentralization and security.

Solution: Building a secure, custom appchain with Polkadot SDK

Chainflip chose the Polkadot SDK (which includes the Substrate framework) for its developer-friendly environment, flexibility, and the team’s strong connections within the Polkadot ecosystem. Polkadot’s modular architecture and use of Rust—a language known for its security and efficiency—aligned perfectly with Chainflip’s goals. The Polkadot SDK allowed Chainflip to build a custom application-specific blockchain (appchain), giving the team complete control over their protocol and optimizing it for cross-chain swaps.

Leveraging Polkadot’s multichain interoperability, Chainflip expanded liquidity across diverse ecosystems, becoming the first platform to bring Solana assets to the Polkadot ecosystem. By incorporating multi-party computation (MPC) and threshold signature schemes (TSS), Chainflip could facilitate native asset swaps between blockchains under-serviced on Polkadot, like Solana and Bitcoin, eliminating the vulnerabilities introduced by bridging mechanisms.

Results and impact

Since its launch, Chainflip has introduced secure Bitcoin and Solana swaps into the Polkadot ecosystem, processing over $535 million in swap volume within six months. This rapid adoption highlights the platform’s solid product-market fit and ability to meet the growing demand for decentralized cross-chain swaps. Additionally, Chainflip's contribution to the Polkadot ecosystem goes beyond its own protocol. By identifying and addressing niche bugs in the Substrate code, the Chainflip team has improved the overall functionality and reliability of Polkadot's infrastructure.

What’s next

Chainflip completed its DCA (dollar-cost averaging) product update, improving pricing efficiency by minimizing slippage, providing even tighter swaps, and bringing a centralized exchange (CEX)-like experience to decentralized swaps.

Chainflip also plans to expand its integration with the Polkadot ecosystem by connecting with the Polkadot Asset Hub, aiming to serve as one of the gateways for asset transfers into and out of Polkadot. The Polkadot Asset Hub is a secure platform for managing a wide range of assets, including native tokens and onchain representations of external reserves. By leveraging the Polkadot Asset Hub’s trusted connection with the Polkadot Chain, Chainflip will offer seamless cross-chain transactions, aiming to position itself as one of the preferred solutions for linking the Polkadot ecosystem with other blockchain networks.

“Polkadot’s modular architecture, combined with the security and efficiency of Rust, aligned perfectly with our goals, enabling us to build an application-specific blockchain tailored for secure cross-chain swaps.”