Hydration optimizes liquidity management for greater DeFi efficiency

Hydration streamlines DeFi by unifying liquidity across chains, eliminating bottlenecks, and leveraging Polkadot’s multichain infrastructure.

By Polkadot•October 31, 2024

By Polkadot•October 31, 2024

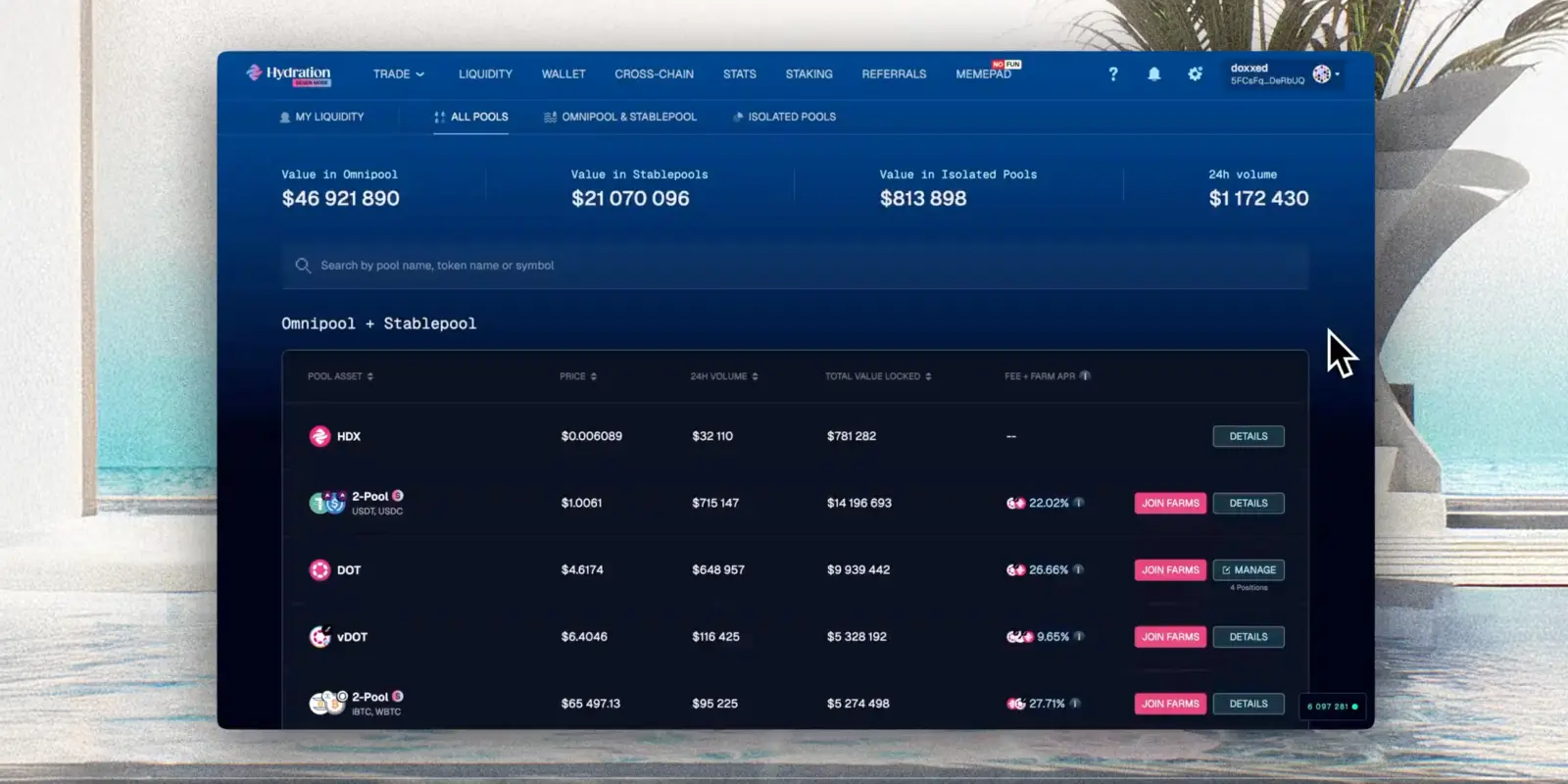

TVL increased from $0 to $45M since launching Omnipool

160+ tradeable assets are supported on Omnipool

Hydration aims to transform the DeFi landscape by solving critical challenges that create inefficiencies in traditional liquidity pools, including fragmented liquidity, price slippage, and cost volatility during network congestion. By leveraging Polkadot’s modular architecture and shared security model, Hydration offers a scalable solution that addresses the complexities of decentralized finance.

Challenge: Managing fragmented liquidity and network congestion

The DeFi industry has faced significant hurdles in managing liquidity across fragmented pools, leading to inefficiencies like multiple trade fees and price slippage. These issues become particularly pronounced during high-volatility events, such as Ethereum’s congestion on Black Thursday, which resulted in cascading liquidations and prohibitively high transaction fees. Hydration sought a network with better control over block production to prioritize critical transactions during high-stress periods while ensuring security and interoperability across multiple chains.

Solution: Leveraging Polkadot for control, security, and interoperability

Polkadot’s shared security model and control over block production provided Hydration the flexibility to manage transaction priorities, even during network congestion. This enabled Hydration to prioritize essential transactions, such as liquidations, without compromising security. With Polkadot, Hydration avoided the need for a separate, costly validator set, further optimizing the platform’s cost-efficiency. Additionally, Polkadot’s XCM (cross-consensus messaging) enabled integration with Ethereum via Moonbeam, bringing liquidity from other blockchain networks into Hydration’s ecosystem.

Results and impact

Since launching Omnipool in January 2023, Hydration’s total value locked (TVL) has grown from $0 to $45M, supporting over 160 tradeable assets. Features like MetaMask compatibility and Moonbeam Routed Liquidity (MRL), which enables cross-chain liquidity flows into Polkadot from ecosystems like Ethereum and beyond, have enhanced both user experience and liquidity management. As an active DEX in Polkadot's DeFi ecosystem, Hydration has increased transaction volumes and secured liquidity and incentives from the Polkadot Treasury to further scale its impact.

What’s next

On the horizon, Hydration has several initiatives in the works, including the introduction of its stablecoin, HOLLAR, along with an AAVE v3-powered money market that allows users to borrow and lend assets like Bitcoin. Their entire stack will be vertically integrated, enabling unique future features, such as using Omnipool farming positions as collateral for borrowing and the implementation of ICE (Intent Composing Engine), an intent-based trading model designed to minimize slippage by matching trade intents. Hydration aims to enhance liquidity options and introduce new features to strengthen its role within the Polkadot ecosystem, with a focus on improving user experience.

“With Polkadot, we are able to secure Hydration for a fraction of the cost of doing so elsewhere—allocating only ~11% of HDX supply to the initial Parachain slot and decentralized sequencer rewards. As a result, a much larger portion (~27%) could be allocated towards growth initiatives to fully capitalize on the benefits of building an appchain. This includes a vertically integrated DeFi stack featuring the holy trinity of swaps, borrowing, and stablecoin—all built on a bedrock of deep liquidity and efficient block production.”