The most impactful blockchain use cases in 2025 and why Polkadot is leading the way

Explore the top blockchain trends of 2025, from decentralized AI and tokenized assets to enterprise adoption and Web3 gaming. Learn how projects powered by Polkadot are shaping the future of finance, infrastructure, and digital identity.

By Meesh Nguyen•February 4, 2025

By Meesh Nguyen•February 4, 2025

What you can expect

- Expanding blockchain applications across industries

- Real-world asset tokenization brings tangibility onchain

- Decentralized finance brings financial accessibility to banking

- Stablecoins and CBDCs: The evolution of onchain finance

- Real-world infrastructure goes onchain with DePIN

- Integrating blockchain with emerging technologies

- Bridging AI and blockchain: the rise of decentralized AI (DeAI)

- Web3 gaming moves from play-to-earn to play-to-own

- Securing identity and authenticating ownership onchain

- The business case for Blockchain-as-a-Service (BaaS)

- Embracing the path forward

Blockchain technology has redefined how ownership, value, and data are managed, shifting reliance away from centralized control and toward trustlessness and efficiency. What began as a breakthrough in decentralized value exchange has matured into a foundational layer of modern digital infrastructure, powering applications across finance, AI, and enterprise management.

Web3’s history has been shaped by cycles of public excitement followed by quieter phases of development, but the technology itself has steadily progressed. In earlier years, these quieter moments, often dismissed by outsiders, were periods of focused development where builders refined architectures, improved scalability, and brought decentralized networks closer to mainstream adoption. Today, major institutions and governments move beyond experimentation, confidently deploying blockchain solutions at scale.

The momentum is undeniable. The World Economic Forum projects that 10% of global GDP could be tokenized and stored onchain by 2027, signaling the expanding role of decentralized platforms in the global economy. While social sentiment may fluctuate, the core technology continues to integrate into the fabric of global industries, making blockchain more relevant than ever.

Expanding blockchain applications across industries

Blockchain's steady maturation has quietly transformed skepticism into tangible results across sectors. What once seemed like isolated experiments has evolved into a proven framework, with established companies discovering measurable value in their blockchain implementations. As institutional interest grows, these validated solutions are not only optimizing existing systems but also unlocking entirely new market possibilities, reshaping how businesses operate and interact in an increasingly digital economy.

1. Real-world asset tokenization brings tangibility onchain

One of the most significant shifts in blockchain adoption is the move from speculation to real-world applications (RWAs). Tokenizing physical assets—such as real estate, commodities, credit, bonds, intellectual property (IP), and artwork—bridges traditional finance with decentralized technology, making these assets more liquid, accessible, and divisible.

Bringing these assets onchain enables transparency and seamless fractional ownership, creating financial instruments that were previously difficult to trade or transfer. McKinsey projects that the RWA market will reach $2 trillion by 2030, signaling growing institutional interest in tokenized representations of traditional assets.

Polkadot’s ecosystem is already at the forefront of RWA adoption. Projects like Centrifuge enable users to tap into tokenized real-world assets like T-Bills, while Energy Web explores onchain energy trading markets. By offering a secure, scalable, and composable infrastructure, Polkadot continues to drive the next wave of financial innovation.

2. Decentralized finance brings financial accessibility to banking

Legacy financial systems, built on slow and expensive intermediaries, are being disrupted by DeFi, which offers lightning-fast, cost-efficient, and permissionless financial transactions to anyone with an internet connection. No longer a niche experiment, DeFi is emerging as a legitimate alternative to traditional finance, powering decentralized lending, liquid staking, and institutional-grade financial products.

DeFi’s most profound impact lies in financial accessibility. Historically, access to credit, investment products, and capital markets has been disproportionately limited to those with wealth, geographic access, or connections to centralized financial institutions. Decentralized platforms reduce these barriers by offering transparent, trustless, and publicly verifiable financial systems.

Polkadot’s DeFi ecosystem, including projects like Bifrost, Hydration, and StellaSwap, is designed to enhance multichain liquidity and efficiency, ensuring seamless financial interactions across different networks. Meanwhile, institutional adoption continues to grow, with institutions like Fidelity, BlackRock, and Grayscale integrating crypto-based ETFs into their investment strategies.

3. Stablecoins and CBDCs: The evolution of onchain finance

While memecoins dominate headlines, stablecoins remain the most impactful digital assets for real-world financial applications. A cornerstone of decentralized economies, stablecoins function as programmable money, typically pegged 1:1 to government-issued currencies like USD or EUR, commodities like gold, or algorithmic mechanisms. Stablecoins' ability to facilitate instant, 24/7, low-cost, cross-border transactions makes them a critical tool for financial inclusion and global commerce.

Meanwhile, central bank digital currencies (CBDCs) remain one of the most debated applications of blockchain technology. While the U.S. has taken a firm stance against CBDCs under the 2025 administration, other nations are actively exploring CBDCs as a means to modernize financial infrastructure. Regardless of policy positions or public opinion, blockchain-based payment rails continue to provide a secure foundation for digital currencies, shaping the next phase of the global financial system.

4. Real-world infrastructure goes onchain with DePIN

Across smart city streets and energy grids across continents, a new kind of infrastructure is taking shape. Decentralized physical infrastructure networks (DePIN) transform how critical systems operate—from energy and logistics to transportation and telecommunications—by shifting control away from central authorities and enabling community-driven, efficient, and sustainable development.

Projects like Energy Web, Acurast, and peaq—all built on Polkadot—lead the charge, enabling decentralized energy trading, real-time logistics tracking, and tokenized mobility networks. These applications demonstrate how infrastructure built on blockchain platforms like Polkadot can create more resilient and scalable systems, replacing traditional top-down control with decentralized, transparent, and interoperable networks.

Polkadot also plays a critical role in decentralized data management. CESS, a decentralized storage and data provenance network, secures sensitive information onchain while preserving privacy. As DePIN innovations become deeply embedded in global infrastructure, blockchain is solidifying its role as a cornerstone of modern digital governance and enterprise security.

Integrating blockchain with emerging technologies

When blockchain converges with technologies like AI, IoT, and advanced data analytics, it unlocks new possibilities that extend beyond what any single technology can achieve alone. While many of these hybrid solutions are still finding their footing, early implementations hint at their transformative potential. From decentralized AI and verifiable digital identities to Web3 gaming and tokenized assets, these innovations are redefining digital ownership, authentication, automation, and trust in an increasingly interconnected world.

5. Bridging AI and blockchain: the rise of decentralized AI (DeAI)

Artificial intelligence is advancing across multiple fronts, with large language models (LLMs) and generative AI (GenAI) driving the most immediate progress, with artificial general intelligence (AGI) remaining a distant goal. While AI advances at an unprecedented pace, the question of data ownership and provenance remains largely unresolved.

Blockchain is inherently immutable, meaning it’s tamper-proof and emerges as a trust layer for AI, ensuring that data is verifiable, decentralized, and cryptographically secured. Projects like Origin Trail’s Neuroweb and Acurast use Polkadot’s infrastructure to create decentralized knowledge graphs (DKG), and secure offchain compute environments, enabling AI models to access high-quality, original data while fairly compensating data providers. As AI development progresses, blockchain’s role in data integrity, provenance, and distributed computing will become increasingly crucial.

6. Web3 gaming moves from play-to-earn to play-to-own

While there are many crypto gaming formats out there, from play-to-earn games like Axie Infinity to the rise of Telegram’s tap-to-earn mobile games like Hamster Kombat, a quiet shift has been taking place from to-earn models towards play-to-own ecosystems. While in-game economies are the main benefits of most crypto games, focusing on creating long-term digital economies derived from in-game ownership opens the doors for sustainable models that allow for deeper player engagement.

With mobile-first gaming adoption accelerating, particularly due to increased accessibility from mobile devices over traditional consoles, titles by Polkadot-based Mythical Games like NFL Rivals and Pudgy Party, along with the highly anticipated FIFA Rivals, are creating immersive digital economies where players can trade, own, and monetize assets seamlessly. As more gaming studios embrace blockchain technology, Polkadot’s infrastructure ensures high-performance, scalable gaming ecosystems.

7. Securing identity and authenticating ownership onchain

As our lives become increasingly digital—both online and onchain—the need for secure identity verification, data ownership, and asset authentication has never been more critical. Blockchain offers decentralized alternatives to traditional systems, enabling the rise of Decentralized Identifiers (DIDs) and Verifiable Credentials (VCs) that allow individuals to prove identity and retain control over their personal data without third parties. Meanwhile, additional proof-of-personhood mechanisms, like digital individuality, become ever more crucial in a digital landscape where AI skews with our perception of reality.

Non-fungible tokens (NFTs) have moved beyond digital collectibles, emerging as essential tools for asset authentication and provenance tracking. No longer confined to speculative markets, NFTs are being used to secure intellectual property in art and music, improve supply chain management, and facilitate real estate transactions. By existing onchain and recorded on an immutable ledger, NFTs provide transparent, programmable, and tamper-proof ownership verification, reinforcing trust and efficiency in an increasingly digital economy.

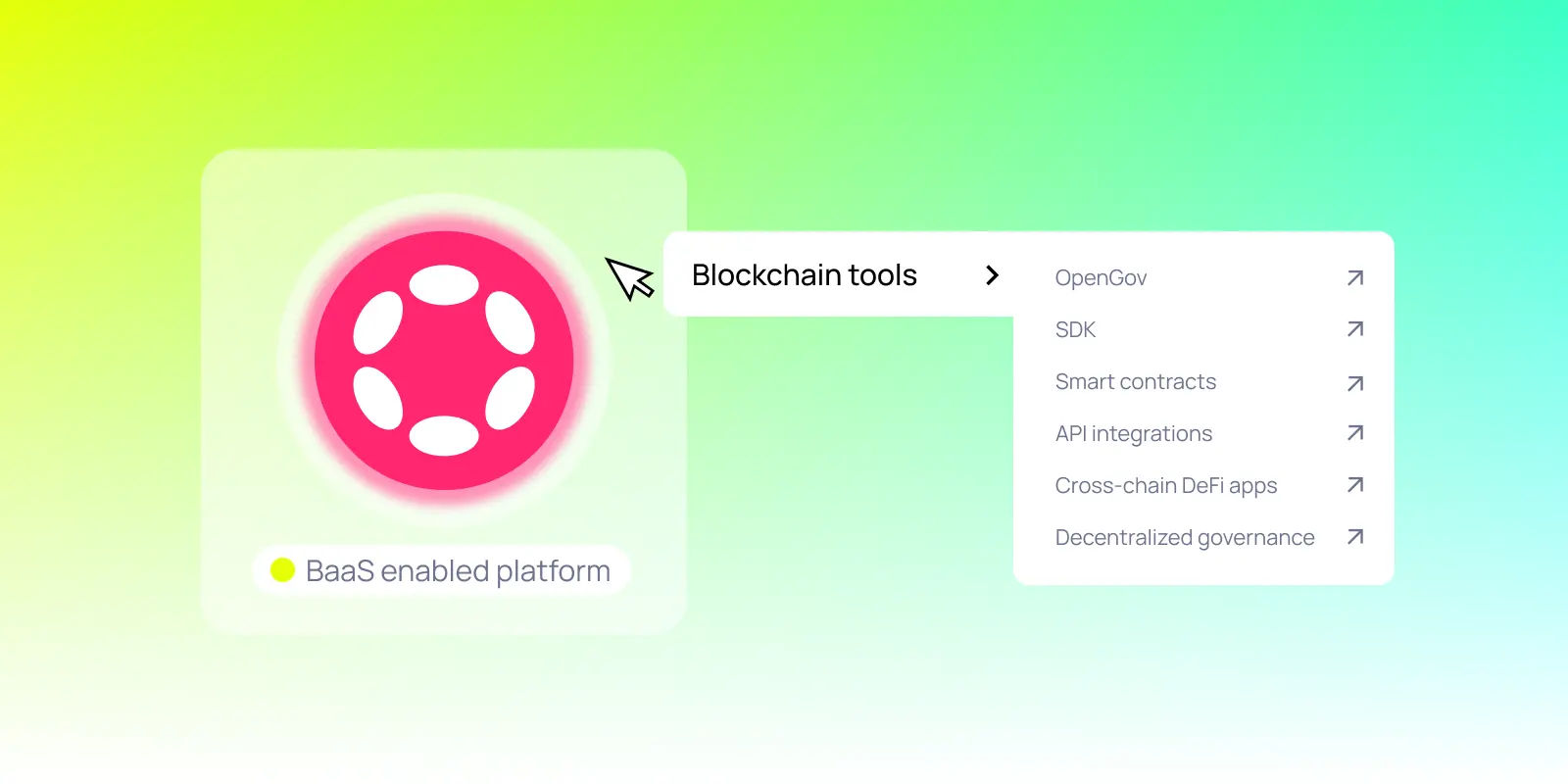

The business case for Blockchain-as-a-Service (BaaS)

Many businesses recognize blockchain’s potential for security, automation, and decentralization, but the technical complexity of building and maintaining blockchain networks remains a major barrier to large-scale adoption. However, just as Software-as-a-Service (SaaS) made software more accessible, scalable, and cost-effective, Blockchain-as-a-Service (BaaS) is doing the same for the adoption of blockchain technology.

For most enterprises, implementing decentralized infrastructure is resource-intensive and technically demanding, making it a major friction point for mainstream adoption. BaaS removes this complexity, offering customizable, turnkey solutions that integrate seamlessly into existing operations. Platforms like Polkadot provide out-of-the-box solutions for blockchain protocol deployment, enabling businesses and teams to leverage decentralization, security, and automation—without requiring deep technical expertise.

Through BaaS-enabled platforms, businesses and developers can access blockchain tools such as SDKs, Polkadot’s decentralized governance protocol (OpenGov), programmable smart contracts, and API integrations to power data management, decentralized governance, and cross-chain DeFi applications. With Polkadot’s shared security model and transparent infrastructure, blockchain integration is now fast, feasible, and frictionless, allowing businesses to integrate decentralized solutions into their existing tech stack.

Embracing the path forward

Clear regulatory frameworks are driving blockchain technology from experimental to essential infrastructure poised for mainstream adoption. With recent policy developments providing clearer pathways for blockchain and crypto applications, the industry is shifting from uncertainty to established guidelines that enable responsible innovation. Financial institutions are launching regulated digital assets, enterprises are deploying compliant decentralized applications, and governments are exploring Bitcoin reserves and blockchain-powered public infrastructure.

Blockchain's core principles of decentralization, transparency, and open access remain intact, but now they're being implemented within frameworks that support institutional adoption at scale. Polkadot's modular architecture exemplifies blockchain's technological evolution, providing enterprises and institutions with scalable, future-proof, cross-chain solutions for building the next generation of technological infrastructure.

For those looking to build, deploy, or integrate onchain solutions, the time to act is now. As blockchain adoption accelerates, the networks that offer scalability, interoperability, and real-world utility will shape its future. Polkadot stands at the forefront of this transformation, providing the infrastructure for enterprises, developers, and institutions to build the decentralized applications and financial systems of tomorrow.