Where real-world value meets access: How Polkadot powers RWA and DePIN

Polkadot is making real-world assets and infrastructure accessible through tokenization, unlocking new opportunities in finance and energy for everyday participants and communities.

By Joey Prebys•March 26, 2025

By Joey Prebys•March 26, 2025

What you can expect

- An overview of how tokenization is expanding access to real-world assets (RWA) and physical infrastructure

- A breakdown of how fractional ownership and smart contracts open participation in high-value markets

- A look at DePIN (decentralized physical infrastructure networks) and how they enable community-led infrastructure

- Real-world examples of RWA and DePIN projects built on Polkadot

- Insights into how Polkadot supports these use cases through interoperability, security, and scalability

Tokenization has already redefined ownership in the creative economy, empowering individuals to own music rights, in-game assets, and other tokenized digital assets. But the next wave is even more impactful: bringing the same level of access and ownership to the physical world.

Imagine owning a piece of a Manhattan skyscraper with just $100 or earning passive income by contributing your extra solar energy to a neighborhood microgrid. These aren’t far-off ideas, they’re already becoming possible through blockchain tokenization.

What's revolutionary here isn't just the technology itself but what it enables: access to real-world assets (RWA) and physical infrastructure, markets that have traditionally been controlled by institutions and closed off to most people. Now, through fractional ownership, smart contracts, and decentralized infrastructure, blockchain is opening the door to broader participation in sectors like real estate, energy, and finance.

Polkadot provides the technology to make this shift possible, offering shared security, interoperability, and the developer tools required to bring tokenized value into a scalable, accessible digital economy.

Tokenization is reshaping real-world assets

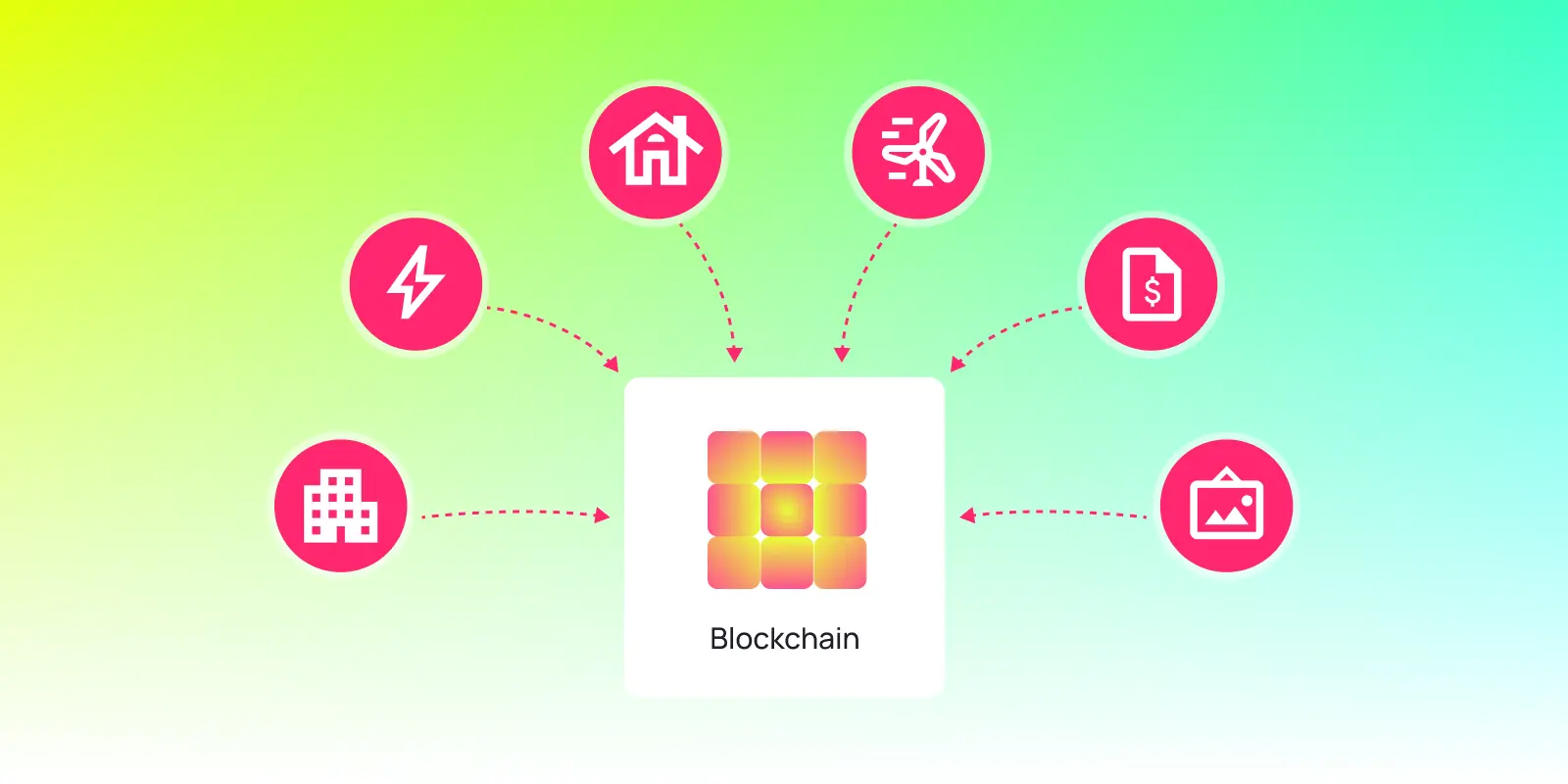

Tokenization refers to the process of converting real-world assets or infrastructure components into blockchain-based digital tokens. These tokens represent ownership, rights, or access and are governed by smart contracts that automate operations like transfers, revenue distributions, and access controls.

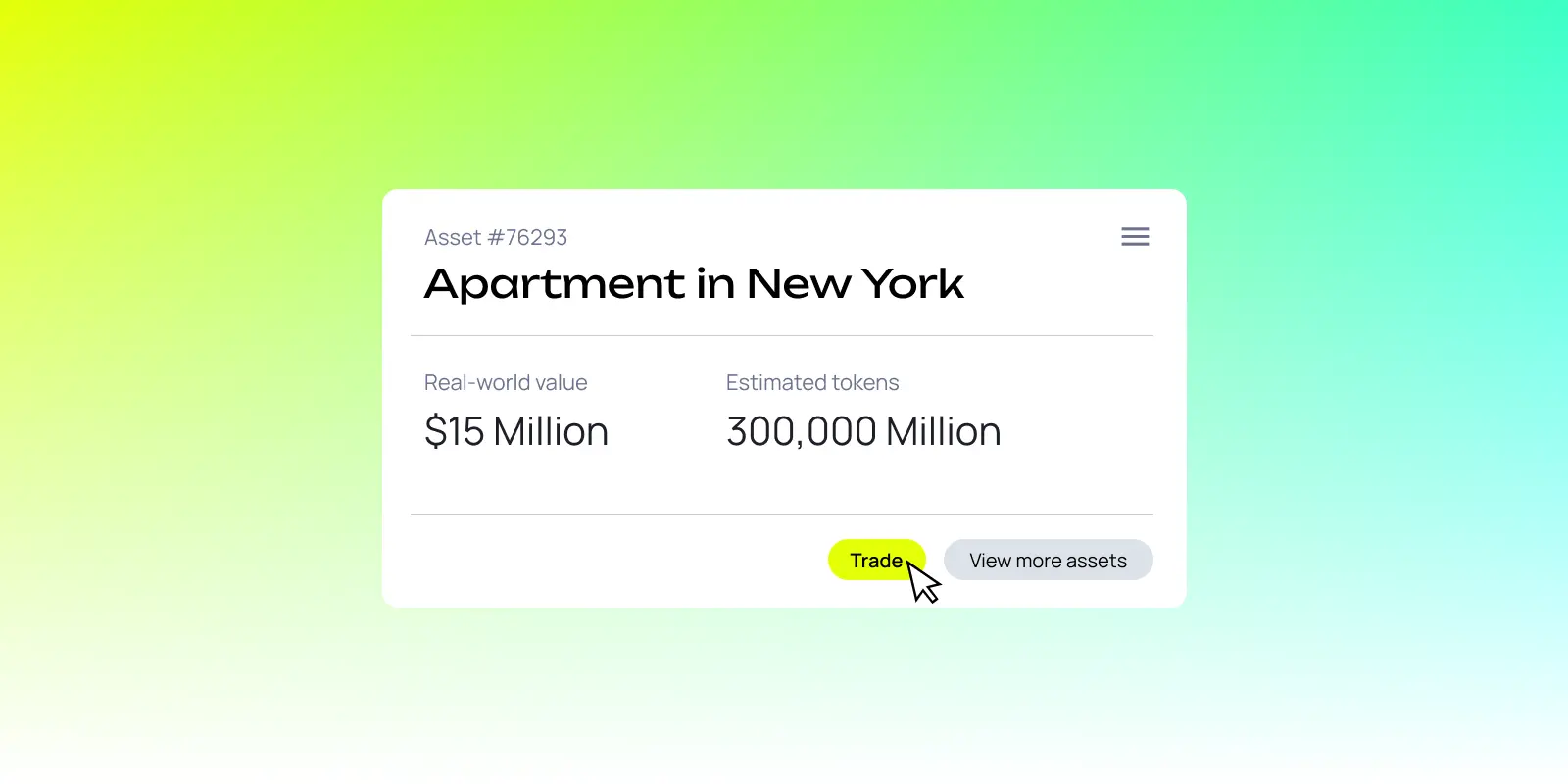

Consider commercial real estate: traditionally, investing in a building required hundreds of thousands or even millions in capital, making it inaccessible to all but institutional investors or the very wealthy. With tokenization, that same property can be divided into thousands of digital tokens, allowing individuals to invest smaller amounts— whether $100 or $10,000—while receiving proportional benefits from rent, revenue, or appreciation.

While tokenization in the creative economy focuses on digital-native ownership and monetization, RWA and DePIN (decentralized physical infrastructure networks) bring that same accessibility to traditionally rigid and exclusive sectors. From tokenized real estate and energy credits to decentralized wireless networks or storage, the potential use cases continue to expand, creating opportunities for broader participation.

Polkadot’s modular technology makes it possible to tokenize real-world assets while ensuring they remain accessible, secure, and interoperable across systems.

How does tokenization expand access to finance and infrastructure?

Similar to tokenization in the creative economy, tokenized assets for real-world infrastructure, commodities, and financial instruments bring programmability and composability to traditionally static industries. Smart contracts embed the rights, obligations, and rules governing each asset directly into code, automating processes like settlements and revenue distributions.

Tokenization facilitates fractional ownership, breaking down capital-intensive assets such as real estate, fine art, and infrastructure into smaller tradable digital units. This lowers investment thresholds and unlocks participation from groups previously excluded in these markets, expanding access to high-value assets that were once out of reach for everyday people.

Take farmland as an example. Traditionally, owning agricultural land required large upfront capital and complex legal structures. Tokenization allows that land to be divided into digital tokens, enabling individuals to invest in fractional shares. As the land generates income from crops or leasing, token holders receive proportional returns, all tracked and managed onchain.

Blockchain brings transparency to physical infrastructure

Blockchain provides a tamper-proof, transparent record of ownership and transactions, providing clarity around provenance, reducing fraud, and streamlining verification. Property deeds and ownership certificates stored onchain are accessible 24/7 and resistant to loss or damage.

Tokenization also unlocks participation in high-value infrastructure projects that were once only available to institutions. Skyscrapers, renewable energy grids, and other physical assets can be fractionalized, offering ownership opportunities for retail investors and communities alike.

The benefits of digital asset tokenization in finance & infrastructure

Tokenization unlocks a wide range of benefits across financial markets and infrastructure, but its most transformative impact is accessibility:

- Enhanced liquidity: Smaller, tradable digital tokens bring liquidity to traditionally illiquid assets.

- Fractional ownership: Breaks down expensive assets for broader participation.

- Onchain transparency: Immutable records reduce fraud and increase trust.

- Interoperability: Assets can move across chains and interact with different platforms.

- Smart contract automation: Reduces middlemen, streamlines processes, and lowers costs.

RWA: Bridging physical & digital markets

RWA tokenization is transforming finance by converting physical assets like real estate, gold, or even intellectual property, into blockchain-based digital tokens that can be fractionalized or traded. This brings new levels of access and liquidity to markets that have historically been gated.

While traditional investments might require large capital commitments and paperwork, tokenization enables a wider range of investors to engage with high-value assets, all tracked and settled onchain.

Platforms like Centrifuge, built on Polkadot, allow businesses to tokenize offchain assets like invoices for small and medium-sized enterprises, unlocking financing for them while giving investors access to yield-bearing, asset-backed products. Similarly, Xcavate opens real estate investment to a broader audience by making ownership more transparent and efficient.

Connecting tokenized RWAs to interoperable blockchain networks like Polkadot expands their utility by unlocking cross-chain access and composability with other blockchain ecosystems. This integration opens the door to new markets and services, boosting liquidity and encouraging broader participation.

DePIN: A new model for community-owned infrastructure

DePIN is reimagining how physical systems are built, owned, and governed, using blockchain to enable community participation and decentralized ownership of infrastructure. By shifting ownership of essential resources like energy, bandwidth, and storage away from centralized corporations and toward communities, DePIN empowers individuals to take control of critical resources. These resources can be turned into tokenized digital assets, creating opportunities for equitable access and economic participation.

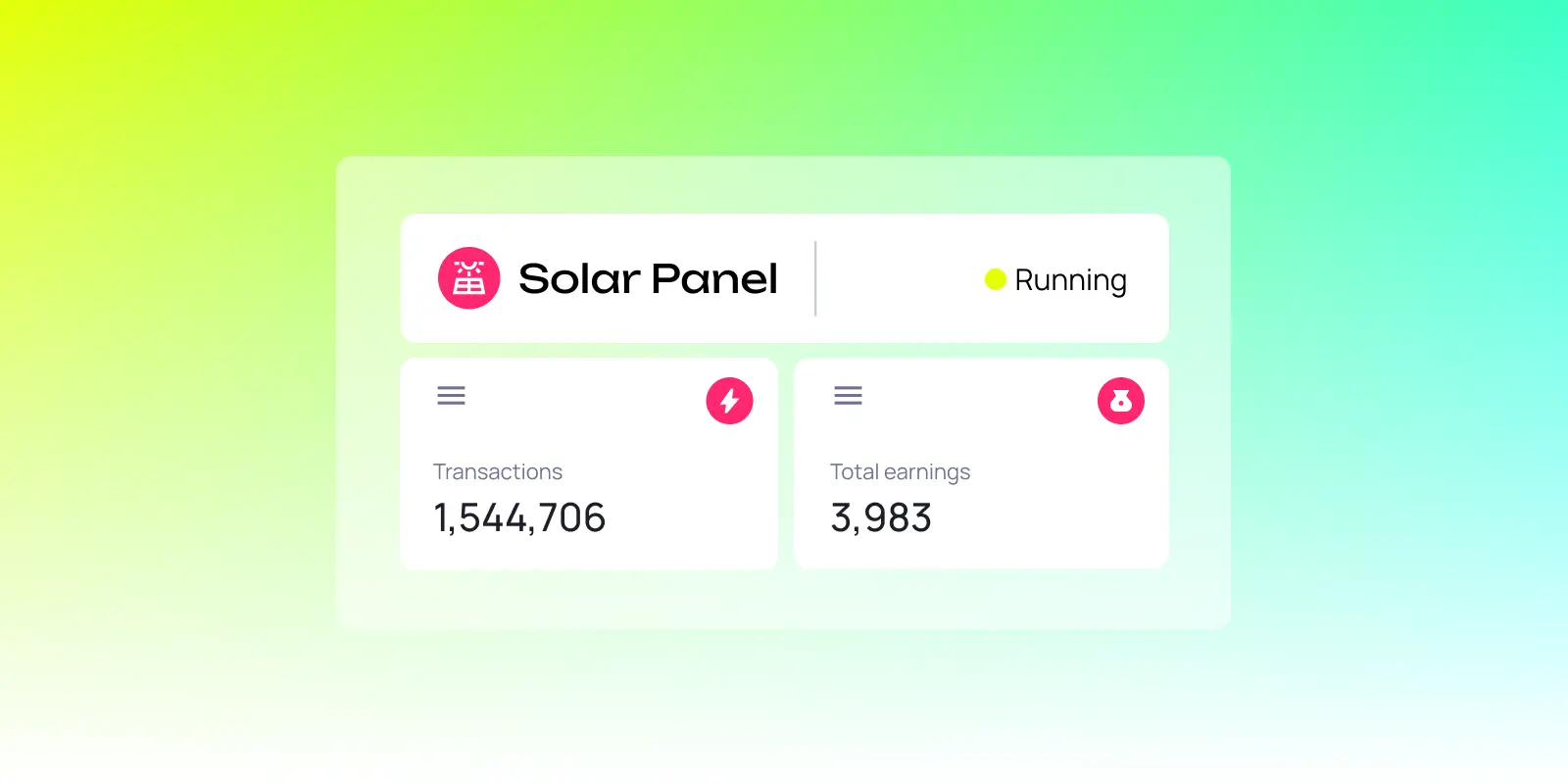

Imagine turning excess power from your rooftop solar panels into a tokenized asset you can trade or share. DePIN brings that possibility into the digital economy, allowing individuals and devices to contribute to and benefit from shared infrastructure.

While early use cases focus on energy and digital infrastructure, DePIN has the potential to expand into transportation, logistics, and public systems. Projects like MapMetrics, a decentralized navigation platform, point toward a future where infrastructure is not just used by communities but owned and shaped by them.

How does tokenization support infrastructure projects?

Tokenization makes DePIN models possible by introducing new ways to fund, govern, and scale infrastructure. Smart contracts automate everything from rewards to access management, while tokens give contributors ownership, voting rights, and service access.

With support from IoT devices, APIs, and oracles, tokenization enables secure, transparent, and decentralized coordination at scale, putting infrastructure in the hands of the many rather than the few.

Real-world examples of DePIN in action

Builders in the Polkadot ecosystem are already proving what’s possible:

- Energy Web is helping communities build more sustainable and reliable energy systems by connecting renewable sources like solar panels and batteries to the blockchain. By decentralizing energy infrastructure, it creates peer-to-peer power-sharing models that put ownership in the hands of users.

- Acurast enables developers to run AI models on mobile and IoT devices while preserving user privacy. Its decentralized compute model allows individuals to contribute unused processing power and be rewarded for participation.

These projects demonstrate how tokenization is already breaking down traditional infrastructure silos and putting users in charge.

Polkadot: Infrastructure for a more inclusive digital economy

Polkadot provides the foundation that RWA and DePIN require, with interoperability, shared security, and scalability built into the protocol:

- Interoperability: Polkadot’s Cross-Consensus Messaging (XCM) protocol allows applications to communicate with other blockchains and offchain systems. For DePIN, this supports IoT integration, supply chains, and peer-to-peer energy networks. For RWA, it allows tokenized assets to access liquidity through DeFi protocols on Polkadot and beyond, including Ethereum.

- Shared Security: Polkadot’s shared security model pools validator resources, allowing rollups to inherit the security of the Polkadot Chain, and eliminating the need for individual rollups to manage their own validator network. The shared state between the main chain and rollups ensures trust assumptions are limited, which is critical for protecting sensitive infrastructure and safeguarding regulated assets.

- Scalability: Polkadot’s modular architecture supports parallel transaction processing, while Polkadot 2.0 features like elastic scaling dynamically allocate multiple cores to rollups based on demand. This enables high-throughput systems to efficiently handle large transaction volumes, whether it's processing data from connected devices or facilitating micro-investments in tokenized real estate and renewable energy.

What’s next for tokenized infrastructure and assets?

Tokenization is fundamentally redefining who can participate in and benefit from our economic infrastructure. By breaking down barriers to entry and enabling community ownership, these technologies are creating a more equitable digital economy.

Ready to participate?

- Developers: Start building with Polkadot

- Users: Explore tokenized assets on Polkadot to see these systems in action

The future of ownership is being built now—and it’s open to everyone.