Making History, Again: Polkadot Auctions 1-5

Following the successful completion of Polkadot's first batch of auctions, we review what happened and look at the data.

By Polkadot•December 21, 2021

By Polkadot•December 21, 2021

By Jonas Gehrlein, Web3 Foundation Research Scientist

Introduction

The Polkadot network has reached yet another remarkable milestone, delivering the final piece of functionality to achieve the vision of Polkadot as outlined in the whitepaper (aka the Polkadot Paper). The first five slot auctions have successfully concluded and the winning parachains were onboarded on December 18th. With this, we, as a community, are making history — again. Many parachain teams have been working tirelessly for several years to build their applications and make Web3 and its vision a reality. Now the time has finally arrived: parachains are live on Polkadot.

Most of the winning teams have already gained experience running a parachain on Kusama, Polkadot’s canary network. There, the code for crowdloans, auctions, and parachains has been battle-tested and refined, providing a smooth operation for both the parachain teams and contributors. Before diving into the data, I will begin with a summary of the auction format and the crowdloans for readers who are unfamiliar with them. Note that this auction report is part of a series of reports that already covered the first and second batch of auctions in the Kusama network. To give new readers the full picture, primers on the candle auction format and the crowdloan mechanism are included again. Readers familiar with those concepts might want to skip to the overview, which provides the data on this first batch of Polkadot auctions.

The candle auction: a refresher

Before proceeding with the analysis of the individual auctions, it is good to summarize the underlying mechanism. The candle auction is an old auction format from around the 16th century where bidding was allowed until a real wax candle went out. The uncertainty about the actual ending time of the auction was used to reduce auction sniping, which was an issue even back then. In auction sniping, bidders squeeze their bid in at the last possible moment, so that other participants don’t have the chance to react with a higher bid. Many of us probably had similar experiences in the past with online auction formats such as eBay.

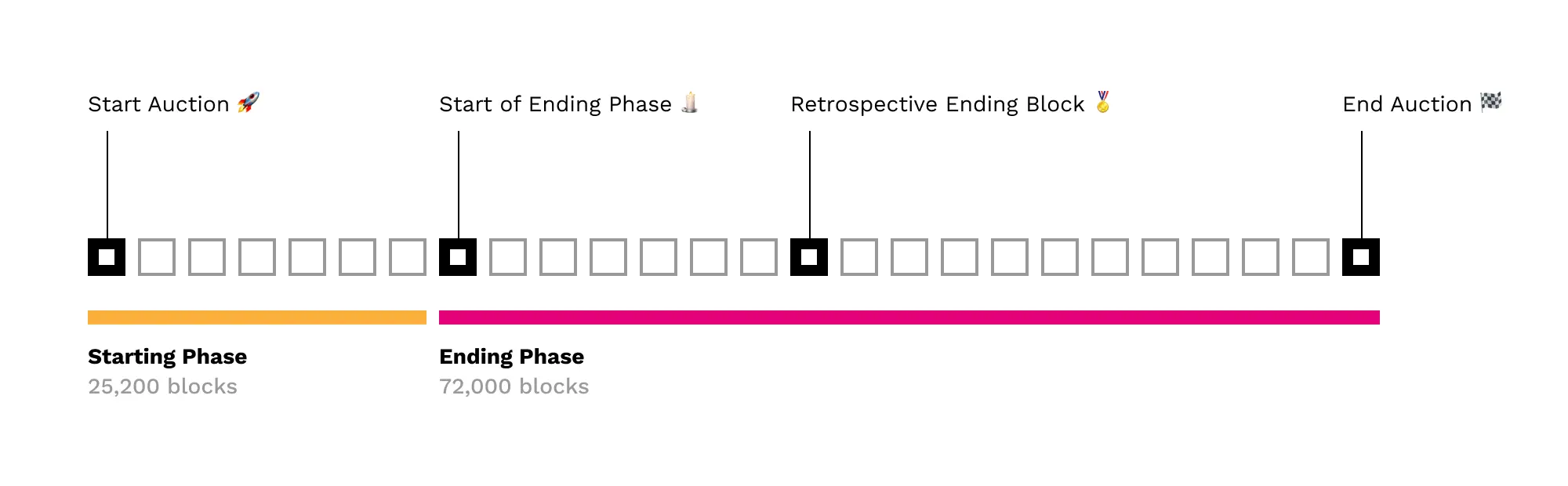

The candle auction format was long considered exotic and has not seen much application. However, it has proven beneficial properties when combined with blockchain technology, both for avoiding sniping and obtaining efficiency (see here for further details). It is therefore considered to be a suitable mechanism for allocating parachain slots on Polkadot and Kusama. In contrast to the ancient candle auction, the end is determined retrospectively. That means, the auction always has a fixed length of time for bidding, and the actual ending block (“retrospective ending block”) is randomly determined only after this. We can mark four important checkpoints to describe the temporal procedure of a candle auction, described in block heights. The following graph illustrates the structure:

The start and end blocks of the auction determine the fixed length of each auction and give participants certainty about the overall framework. The first phase of the auction, lasting exactly 25,200 blocks (around 42 hours), serves as a grace period where teams and users have time to get an overview of the situation, gather information, and set up their bidding/contributing strategies. Although bidding is enabled, the blocks in this phase are not yet considered by the mechanism, i.e., the retrospective ending block cannot fall inside that range.

After that, the ending phase (or candle phase) marks the “real” beginning of the auction. Here, figuratively, the candle is lit. This phase lasts for 72,000 blocks (around 5 days). During this phase, the auction could end at any given block with equal probability (i.e., the candle phase has a uniform termination profile*). Bidding is allowed until the end of the auction. After the official ending, the retrospective ending block is computed using a combination of verified random functions (VRF). Calculating this termination block retrospectively ensures that nobody can predict it before or during the auction.

The winning bids that are contained in the retrospective ending block are then used to determine the outcome of the auction, while all later bids are discarded. This uncertainty and the possibility that bids are not relevant for the final outcome incentivizes early bidding and can thereby reduce sniping. To keep potential confusion of participants at a minimum, there can only ever be one active auction at any time.

Crowdloan mechanism

Technically, a crowdloan is a simple module part of the blockchain that enables projects to gain support for their parachain in a decentralized way. Specifically, tokens are gathered on behalf of the teams, and remain in the custody of and are secured by the Relay Chain. This means that participation in a crowdloan campaign is trustless for users and they can be certain that they will receive their contributions back at one of two predefined dates. The first date corresponds to a project’s crowdloan successfully securing a parachain slot. In this case, tokens can be reclaimed by the users at the end of the lease that the crowdloan obtained. The second date corresponds to a project failing to secure a slot. In that case, tokens can be retrieved directly after the (generally short) duration of the crowdloan ends.

As tokens are reclaimable, the actual costs of users’ contributions, economically speaking, are the opportunity costs that accrue from locking those tokens (e.g., forgone rewards from staking or from using the tokens differently). To provide clarity about when users can expect their tokens back in the event that the crowdloan wins a slot, the leasing period that it bids for is fixed.

Additionally, as a contribution is made the crowdloan module automatically increases the bid by exactly that amount**. If the crowdloan successfully wins an auction, tokens are automatically locked for the period of time and then released and can be reclaimed by the accounts that contributed. Contributions after the termination block (but before the end of the auction) are still locked, but naturally did not increase the winning bid. Any incentive structure for contributing to the crowdloans are arranged by the respective crowdloan projects.

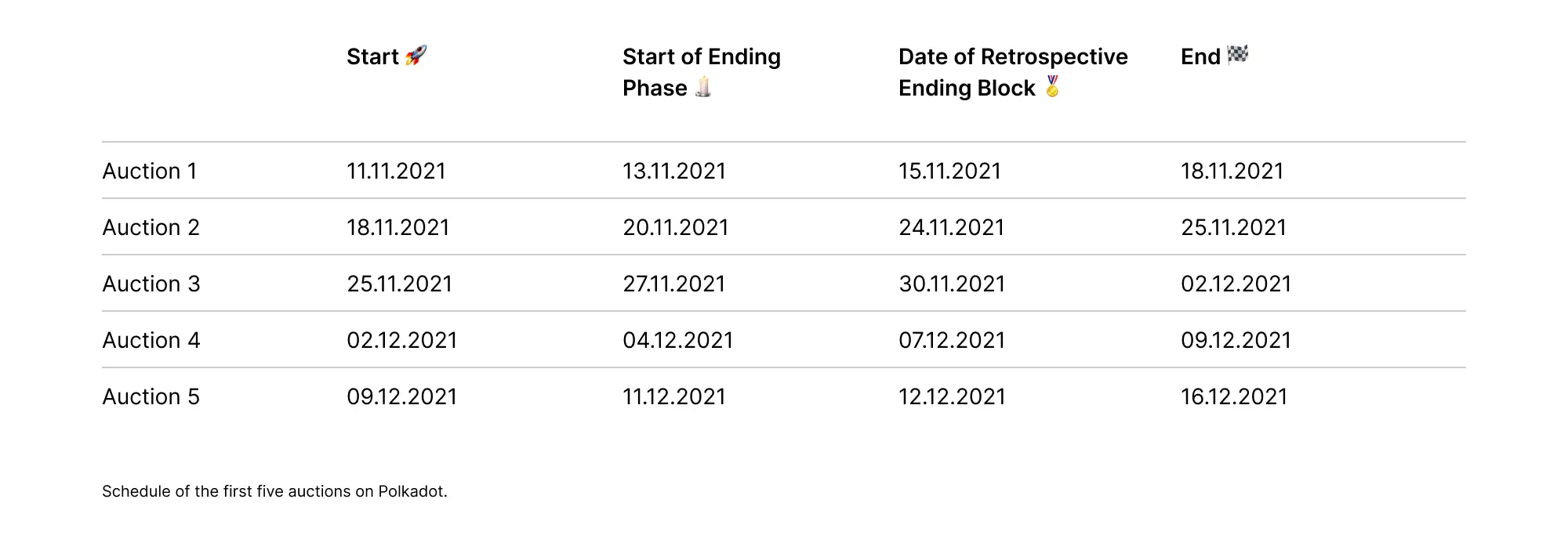

Auction schedule

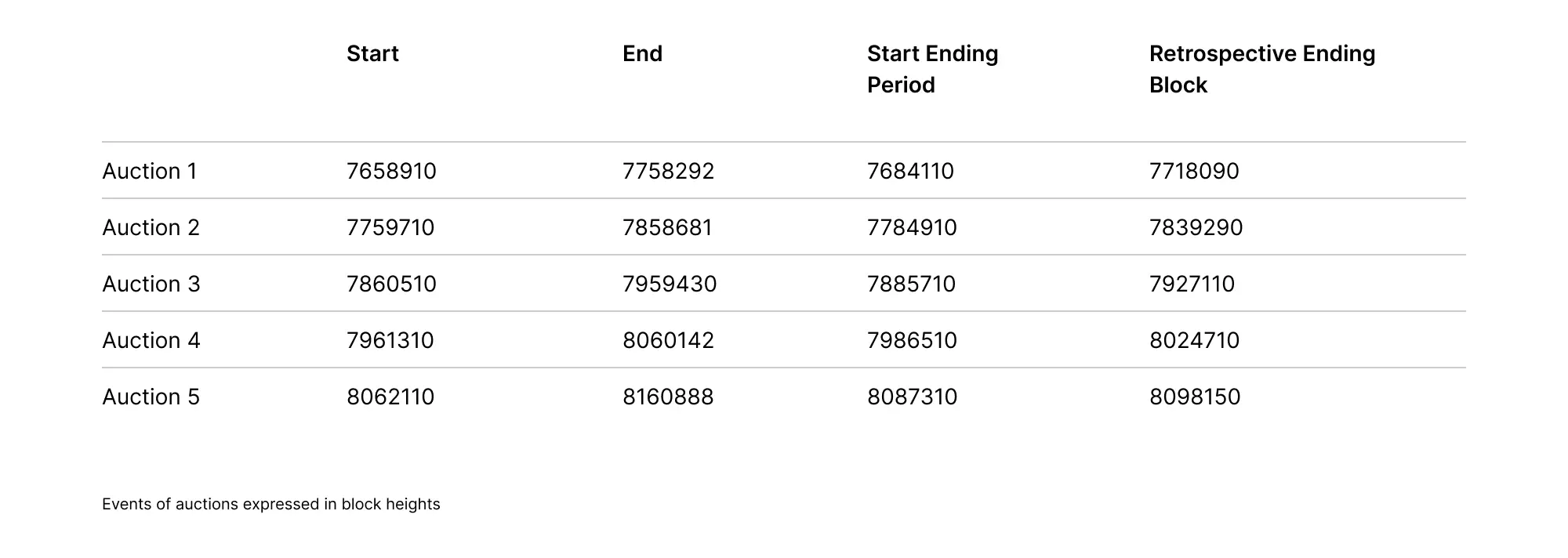

The first batch of Polkadot auctions was enabled by the governance body of the network and was set for the first five available slots. In total, the first batch ran from November 11th until December 16th, 2021. Each auction lasted seven days with a two-day starting and five-day ending period. Although the first five Kusama parachains onboarded immediately after winning a slot, in Polkadot all winners of the first batch began onboarding simultaneously on December 17th. The following table provides the dates for the four important events surrounding each auction (the same table with the events expressed in their block heights can be found in the Appendix).

Overview

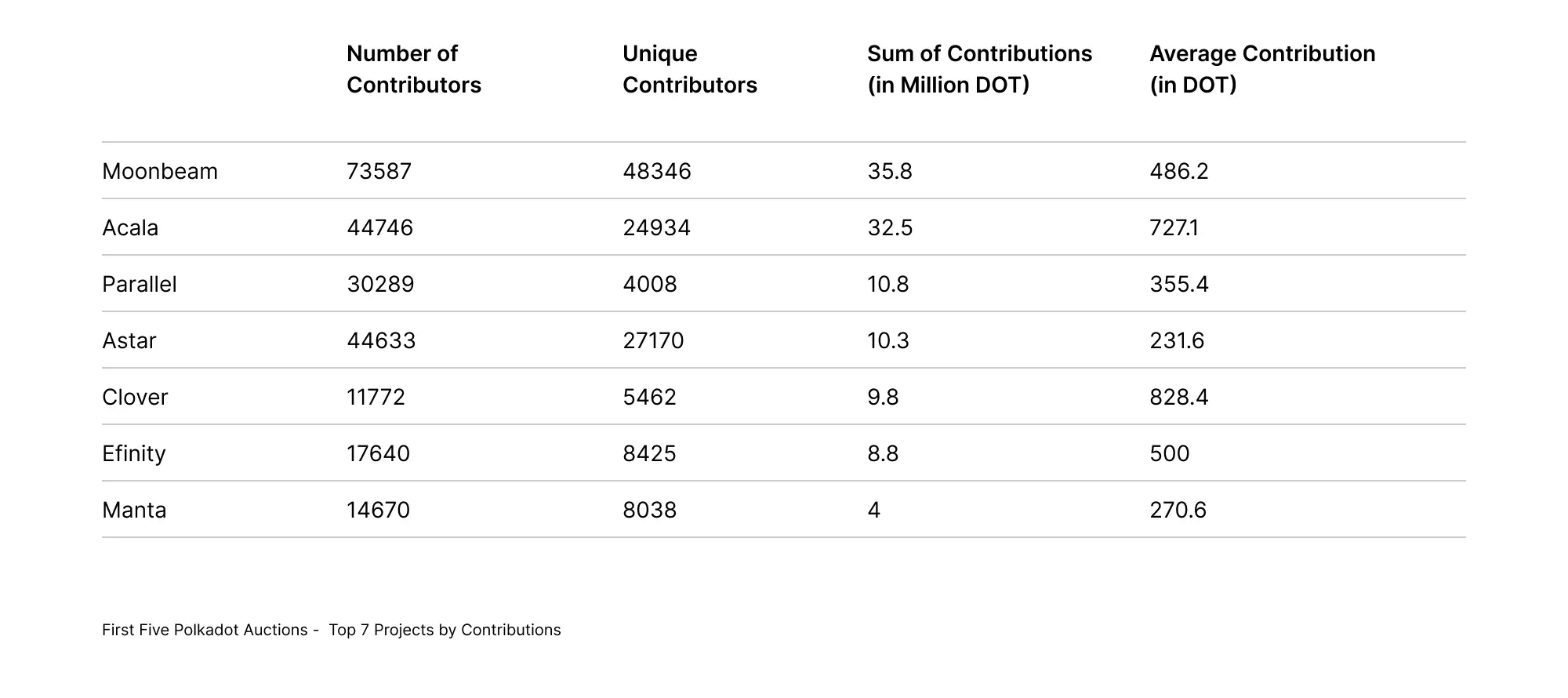

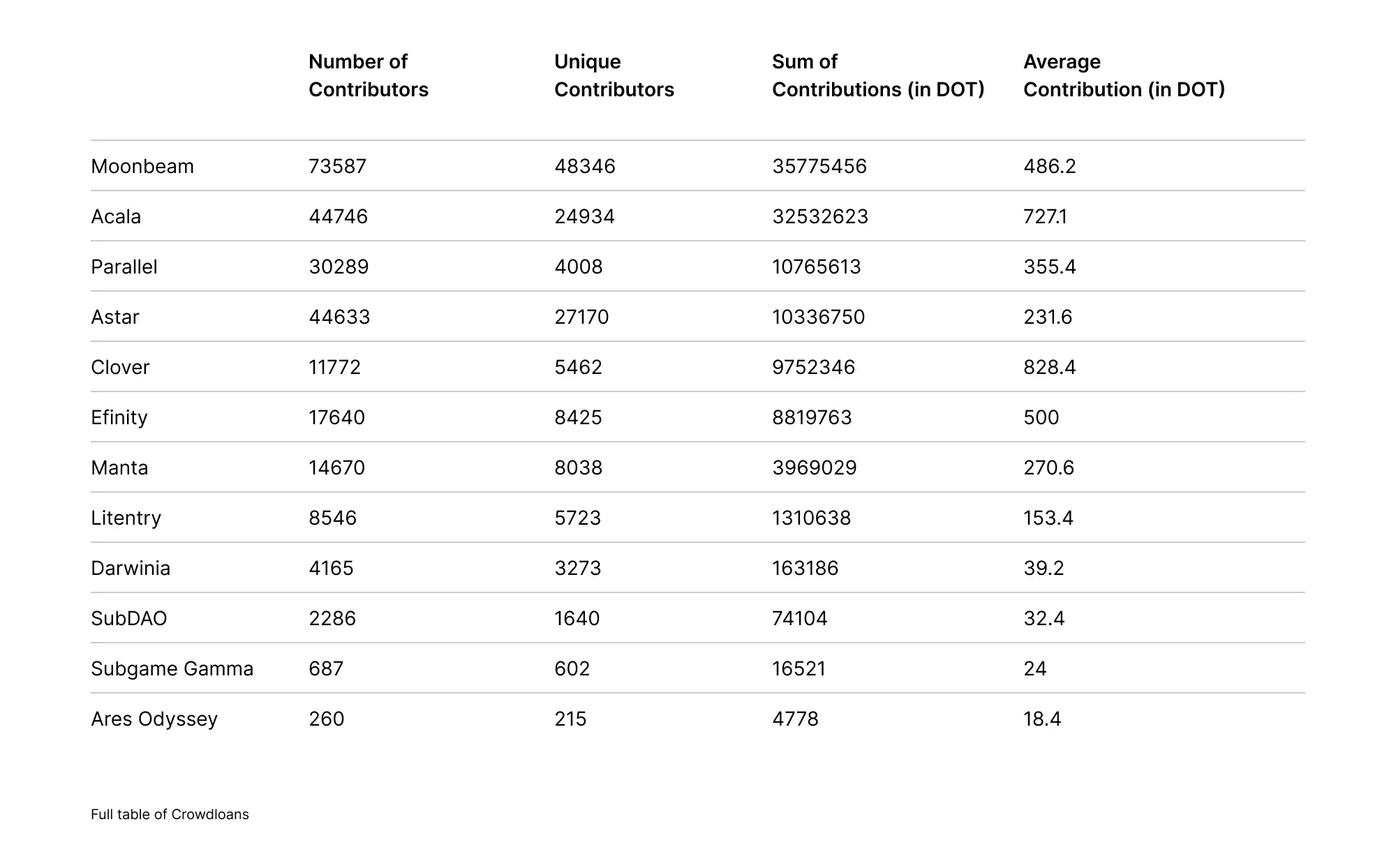

In total, 12 crowdloans registered to participate in the first batch of auctions and have received contributions during the campaign from 77753 unique accounts (compared to 31417 in the first five auctions on Kusama). A total number of 113.5 Million DOT was bonded to crowdloans***. Hereof, 99.2 Million DOT has been locked in slots for 96 weeks (until October 20th, 2023), while the rest can be reclaimed by users as their chosen crowdloans did not secure a parachain slot. At the end of the campaign, from all issued tokens, 54% were locked in staking and 8.65% were locked for successful crowdloans. Individual accounts selected on average 1.8 crowdloans with an average total contribution of 1,460 DOT.

The following table summarizes relevant metrics for the seven projects with the highest locked DOT for crowdloans ordered by the amount of contributions (the full table is available in the Appendix).

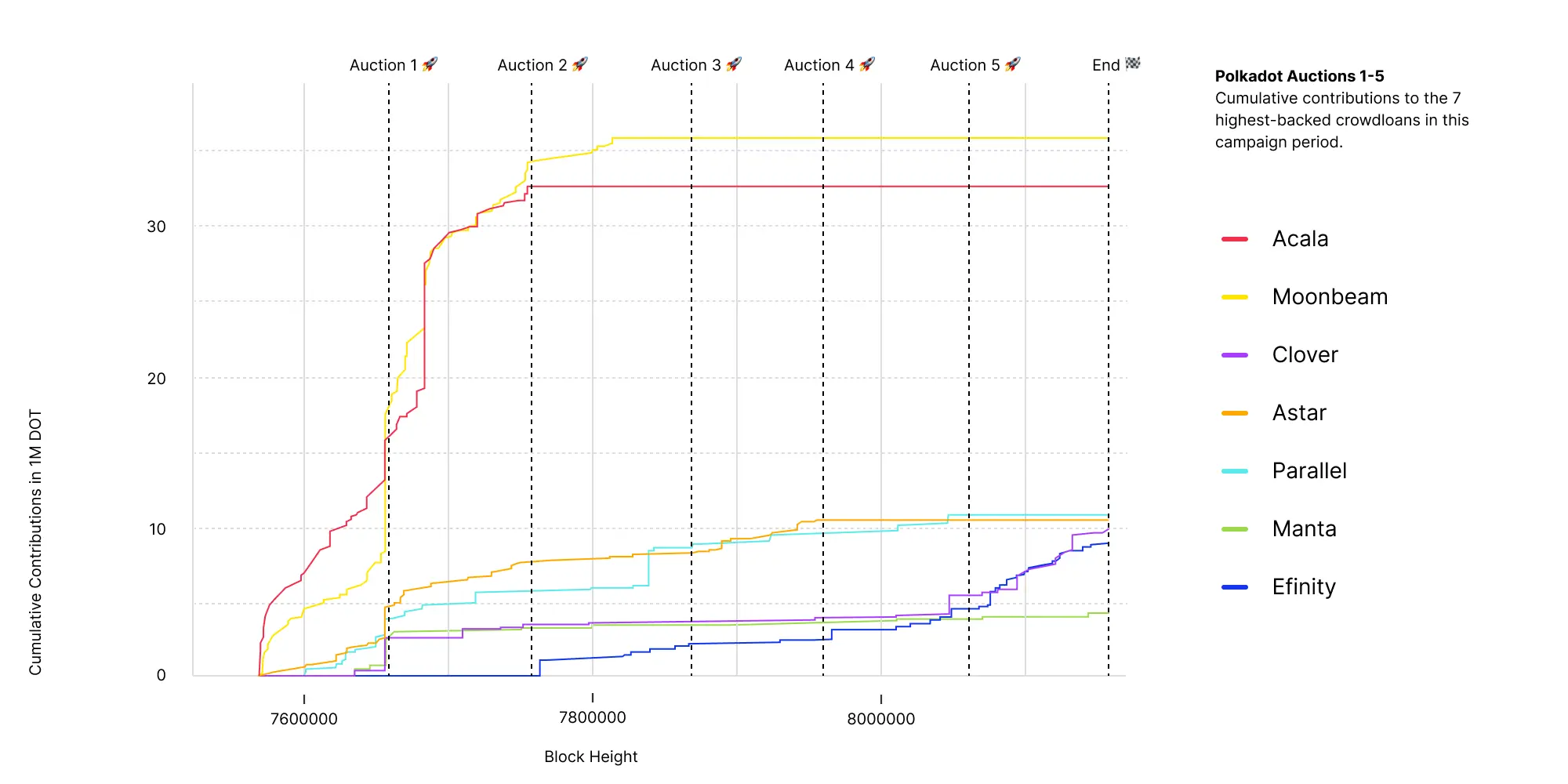

The following graph shows the cumulative contributions of the seven highest-backed crowdloans for the whole campaign. This gives some visual insights about the contribution dynamic to the different projects.

We can observe two crowdloans that took the lead from early on. Those belong to the Acala and Moonbeam teams, which set out in a close head-to-head race for the first ever available parachain slot on Polkadot. But the first auction was not the only one with close outcomes. Another fierce race happened for the third and fifth slot. In the following, we take a closer look at all of them and observe the contribution dynamics of the various crowdloans. As all bids were made for the same leasing periods (full duration of the slot), contributions can be compared within a single graph.

Auction 1-2

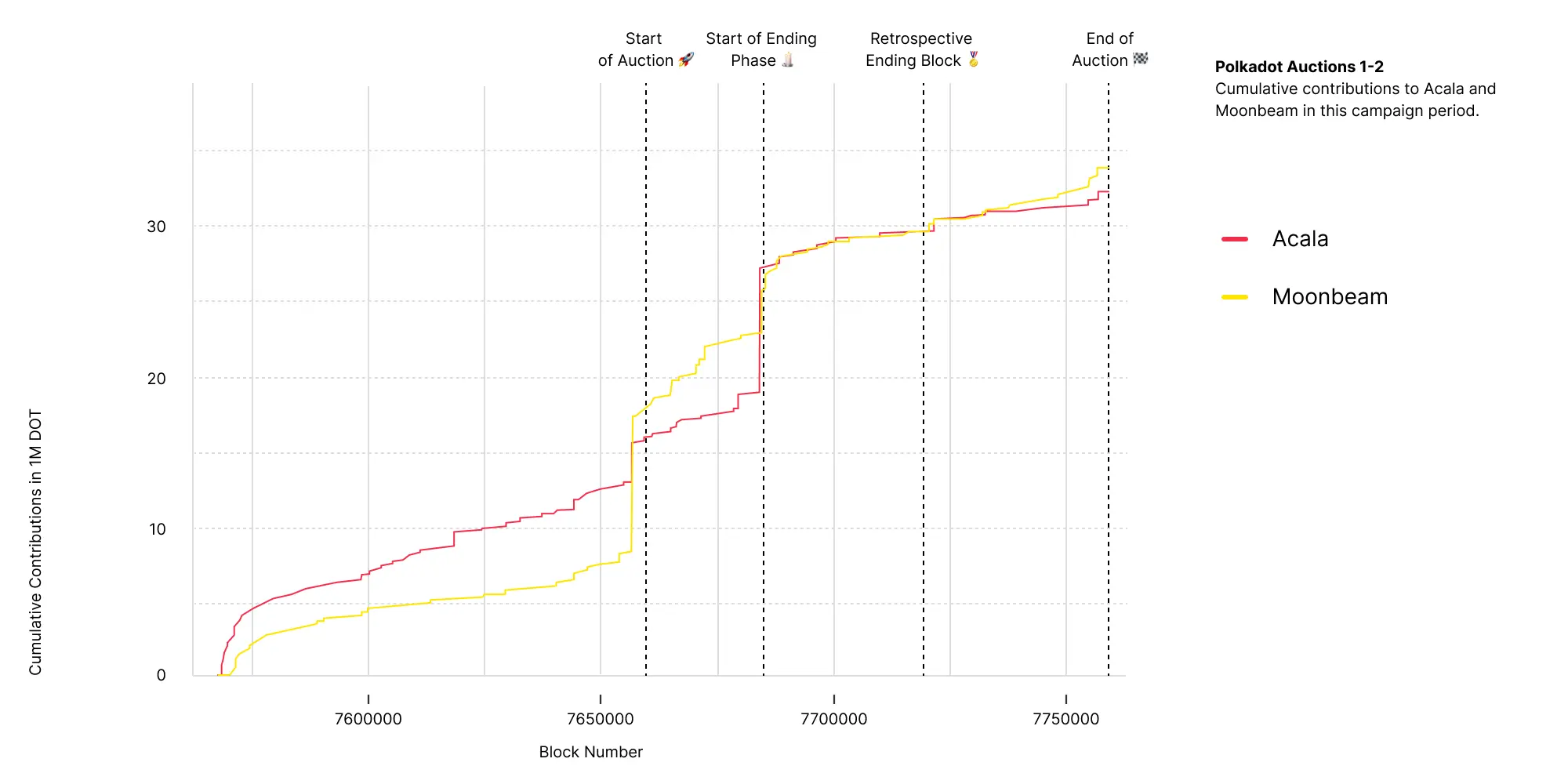

As we can infer from the overview graph, the outcome of the first auction came down to the head-to-head race between Acala and Moonbeam. In the following, we take a closer look at the contribution dynamic of the two teams and fade out the other crowdloans for now.

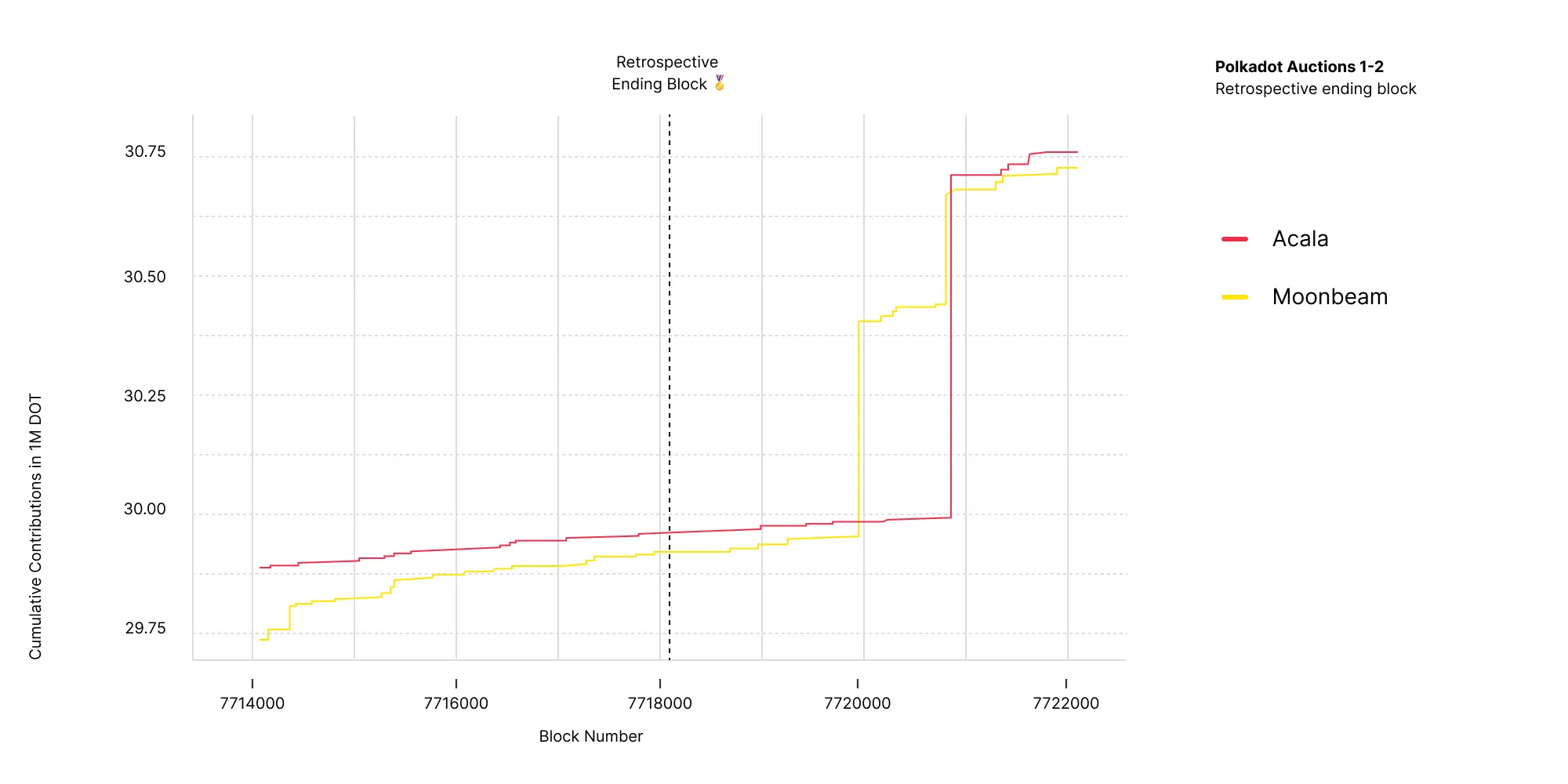

We can observe that contributions to Moonbeam gained traction shortly before the auction officially started. After that, roughly two days of the starting period followed, where the bids were not counted towards the final result (yet). During that time, Acala fell behind but managed to secure a big chunk of contributions just in time for the important ending period (🕯). In this period, having the highest bid (i.e. most contributions) during some blocks gives a realistic chance of winning the slot. In this extremely close race, both teams managed to secure numerous blocks in their favor. Recalling how the mechanism of the candle auctions work, the probability of winning for a project (roughly) corresponds to the share of blocks that are won during the ending period. In this case, Acala held 61.29% of the blocks. Lets see in more detail which block was selected to be the retrospective ending block (🏅) and zoom in around that decisive block (with 4,000 blocks before and after).

In the close-up view above, we can clearly see that the winning bid was held by Acala at the retrospective ending block. If a block only around 2,000 blocks (or ~3.5h) later had been selected, Moonbeam would have been the lucky winner: That is the candle mechanism in action. For more information on how this block is selected, see the section “Who blows out the candle?” here.

As a result, Acala was selected as the first auction-winning parachain ever of the Polkadot network. In this spectacular race, users of the Polkadot network locked a staggering amount of 68.3 Million DOT for Acala and Moonbeam combined.

After the first auction ended, Moonbeam announced that they would stop accepting contributions to their crowdloan to preserve their targeted reward ratio between locked DOT and crowdloan reward tokens. This was possible because they utilized a feature of crowdloans where the creator can require a signature from the creator’s key as part of the crowdloan contribution. This mechanism made it possible to discontinue providing further signatures, thereby preventing further contributions. With the amount of tokens it carried over to the second auction, Moonbeam was able to win it with ease and without any competition and occupies the second available slot on Polkadot. The final cumulative contribution was 35.8 Million DOT locked. Note that this amount actually exceeded that of the previous auction, simply because the crowdloan was active for an additional week.

Auction 3-4

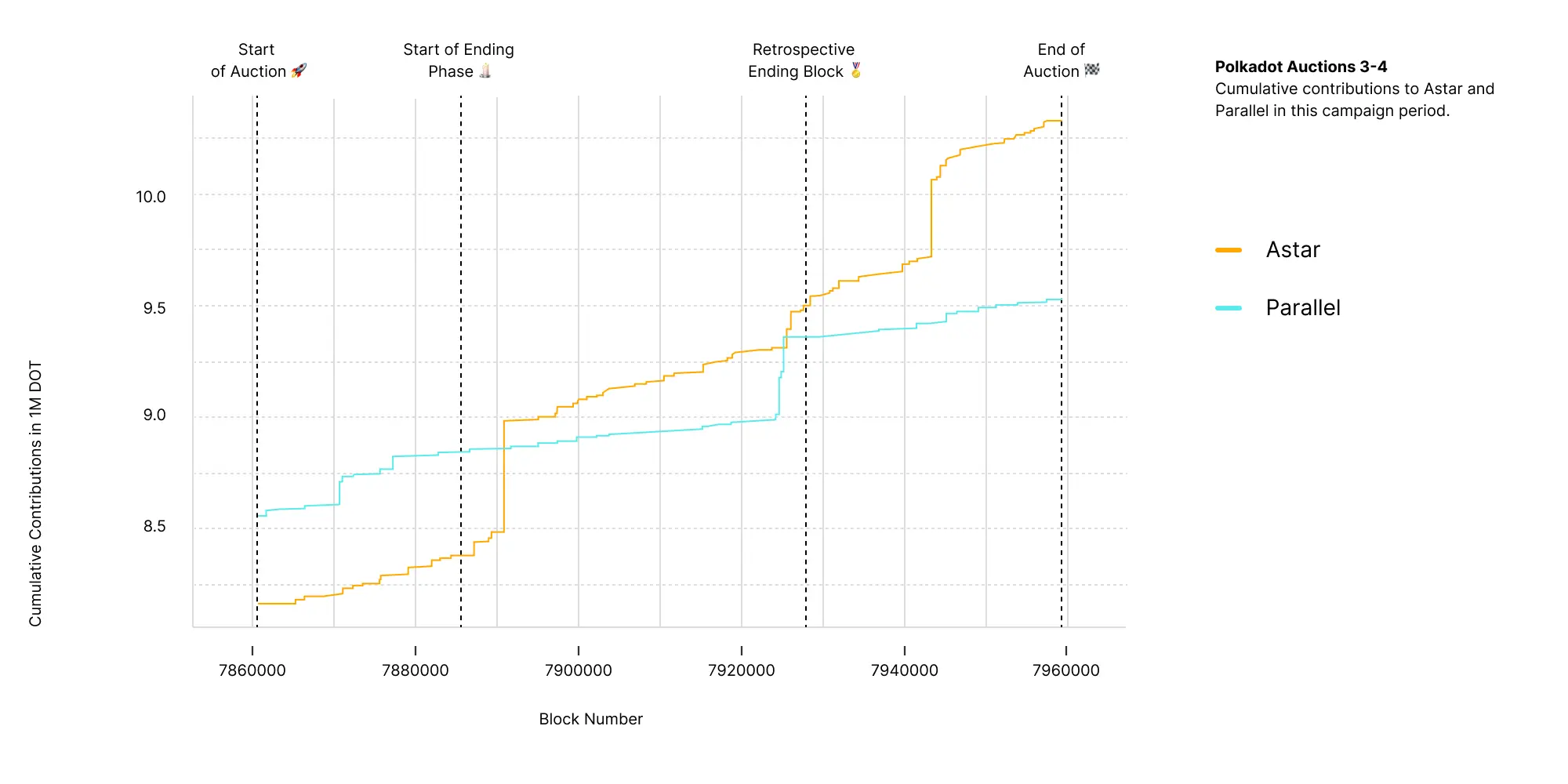

Like the first auction, the third auction turned out to be very exciting as the contributions for two of the teams, Astar and Parallel Finance, came very close to each other over a long period of time. Again, we could observe switching leaders during the ending period, however less frequently.

In the end, Astar was able to lead in 92.64% of the blocks in the ending period and thus, with no surprise, won the third auction on Polkadot. In total, 10.3 Million DOT were locked. With no other project coming close, Parallel won the fourth auction without any competition seven days later, with a total contribution of 10.8 Million DOT. Note that once again, the amount locked exceeded the winning bid from the previous auction.

Auction 5

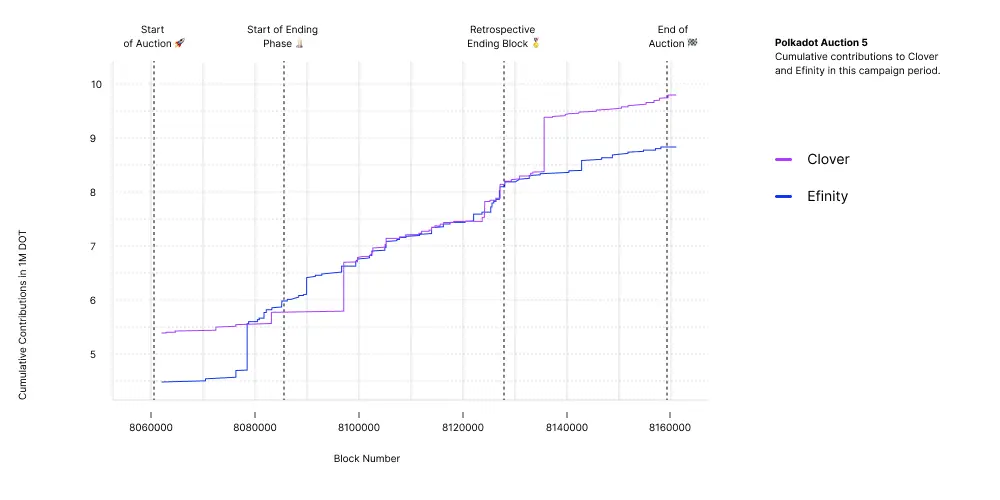

Last but not least, the auction around the fifth slot again saw some tense competition, this time between Efinity and Clover.

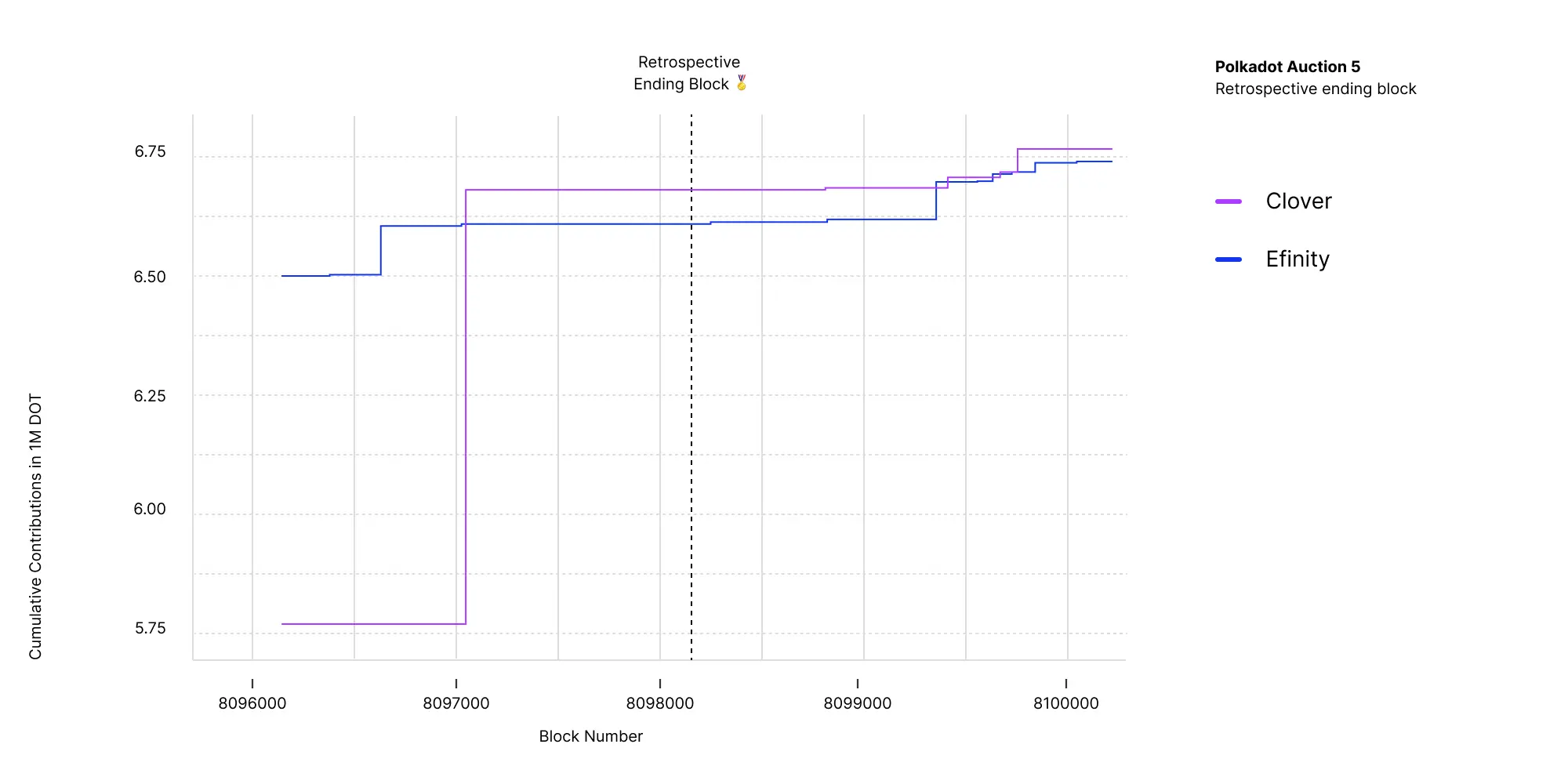

While there was an extended period where both projects were very close to each other, at about two thirds of the ending period Clover secured a large amount of contributions which put them into the lead until the end of the fifth auction. In total, they led 79.55% of all blocks during the ending period. The retrospective ending block (8096150) fell into the early part of the ending period where both teams were still head-to-head. Again, we can take a close-up view on the cumulative contributions around that block.

As we can see above, the decisive block fell into an area where Clover was leading and thereby the result was in line with the overall odds. Thus, Clover became the fifth auction-winning parachain on Polkadot.

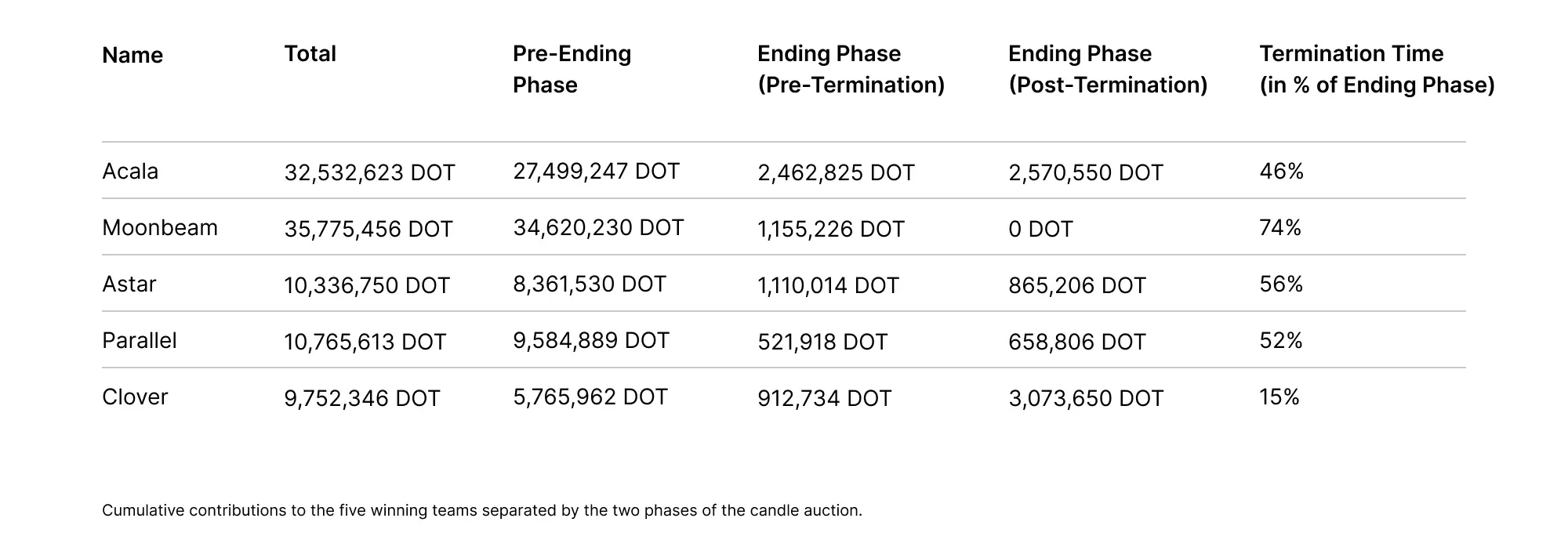

The impact of the candle mechanism

The candle auction is composed of two different stages, namely the starting and ending phase. The latter is further divided (retrospectively), into a period that falls before and after the termination block. This mechanism could lead to the situation where the highest bidder at the end of the auction does not necessarily win the auction, because their winning bid is discarded if it falls into the range after the retrospective ending block. In contrast to auctions on Kusama, that has not happened here. All tokens contributed to a winning crowdloan, including those contributed after the ending block, are locked for the entirety of the respective leasing period. This means that we could observe some inefficiency, both in determining the winner and in locking tokens that did not contribute to a higher winning bid. In the next table, the sum of contributions is separated by the respective phases. Additionally, the table shows when the retrospective ending block occurred as a percent of the whole ending phase.

Conclusion

The first batch of auctions has concluded successfully and the winners began onboarding to the Polkadot ecosystem on December 17th. In total, token holders locked 99.2 Million DOT until October 2023 for their favorite parachain projects. There were no known issues during this campaign and all systems worked as desired, as was expected, because the code had already been battle-tested on Kusama. The first five auction-winning parachains ever to be live on Polkadot are (in order): Acala, Moonbeam, Astar, Parallel, and Clover. Those projects bring new functionality and infrastructure to the ecosystem in the areas of DeFi, EVM-compatibility, dapps and other smart-contract capabilities. But this is only the start. It is exciting to see how Polkadot will develop now that this huge milestone has been achieved. With this, the network finally achieves its vision as outlined in the whitepaper. Five more auctions have already been scheduled, starting from December 23rd, and both teams that did not win in this round and new contestants will open their crowdloans and try to win their place in history as one of the early parachains on Polkadot.

Appendix

Footnotes

*More precisely: To reduce storage requirements, only every 20th block can be sampled and be selected as the termination block.

**To decrease the storage requirements, those bids are actually only cast on-chain once the candle phase starts.

***During the campaign there were already crowdloans registered for the next lease period (i.e., batch 2). The data of those crowdloans are not considered here.