Nomination Pools are Live! Stake Natively with Just 1 DOT.

Stake natively on Polkadot easier than ever and with as little as 1 DOT thanks to this new scalability feature for Polkadot’s staking system.

By Polkadot•November 1, 2022

By Polkadot•November 1, 2022

Stake natively on Polkadot easier than ever and with as little as 1 DOT thanks to this new scalability feature for Polkadot’s staking system.

Nomination pools are a new feature for Polkadot’s staking system that allows users to pool their DOT tokens together on-chain to nominate validators and receive rewards, significantly improving the system’s scalability. Now, anyone with as little as 1 DOT can receive rewards for staking natively on Polkadot.

Coupled with the recently launched Polkadot Staking Dashboard, the new user-friendly staking app that recently came out of beta, nomination pools lower the barrier to entry for participation in staking directly on the network and simplify the staking process. Now, users with less DOT and those looking for a more passive staking experience can stake directly on the network.

Crucially, these updates also reduce the incentive to stake through third-party services and intermediaries. By cutting out the middleman and staking natively (directly on the Relay Chain) DOT holders can help keep Polkadot secure and decentralized while receiving competitive rewards of up to 18%*.

Native, protocol-level nomination pools also represent a major innovation in the broader blockchain industry, where stakers with less tokens are often disadvantaged and staking pools typically necessitate relying on intermediary services.

The need for nomination pools

From the beginning, Polkadot’s Nominated Proof of Stake (NPoS) system was designed for maximum security, decentralization, energy efficiency, and fair representation, efficiently balancing the interests of smaller and larger DOT holders alike. It has always been a goal for Polkadot to provide inclusive access to staking participation and lower the barrier to entry as much as possible for nominators.

But following the launch of Polkadot’s Relay Chain in 2020, rapid scaling of the network in 2021 and an increase in demand for staking participation put a strain on this innovative staking system. To ensure the network's security, a maximum number of 22,500 nominators was introduced and governance passed a series of motions that gradually increased the minimum nomination amount to 160 DOT. This limit was eventually lowered back down to 10 DOT, but the minimum amount needed to be part of the top 22,500 nominators and earn rewards is now dynamically determined and is still somewhere around 170 DOT at the time of writing.

To remedy the system’s scalability issues and remove the limitations introduced on participating as a nominator, several improvements to Polkadot’s staking system were developed over the past year. The most significant and exciting of these is the nomination pools feature, which launched first on Kusama and is now live on Polkadot.

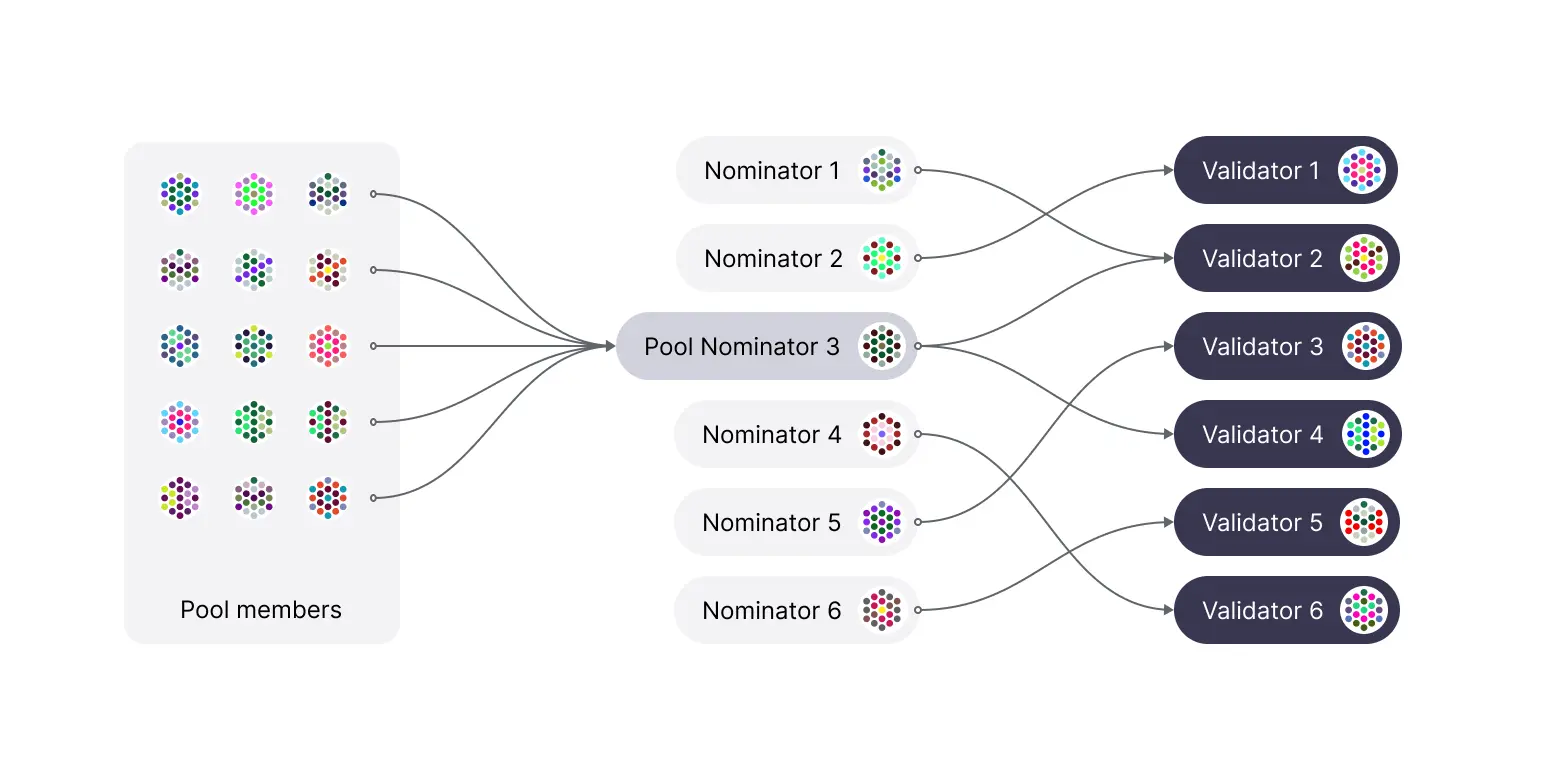

Before nomination pools, the only way to participate in the nomination process and receive rewards natively was for users to directly nominate validators, using their stake of DOT tokens to select up to 16 trustworthy validators.

However, not only does direct nomination require users to have a significant stake in DOT tokens to participate, it also requires playing a more active role in researching, selecting, monitoring, and periodically reevaluating their choice of validators.

With nomination pools, the creator of a pool manages nominations on behalf of pool members, reducing the time and overhead necessary to participate in nomination. Of course, pool members should still conduct their own due diligence when determining which pool to join. In contrast to direct nomination, pools also do not require users to create both a stash and controller account, further reducing the complexity of native staking.

Alternatively, before nomination pools DOT holders could stake indirectly via third-party services and liquid staking providers, but at the expense of network decentralization and security. Indirect staking also meant that DOT holders had to give away their economic voting power to third parties, often handing over a percentage of their rewards in the process.

Beyond making native staking more accessible for those with less DOT, nomination pools also remove the theoretical limit on the number of users the system can handle, allowing it to continue to scale as demand for staking participation continues into the future.

How nomination pools work

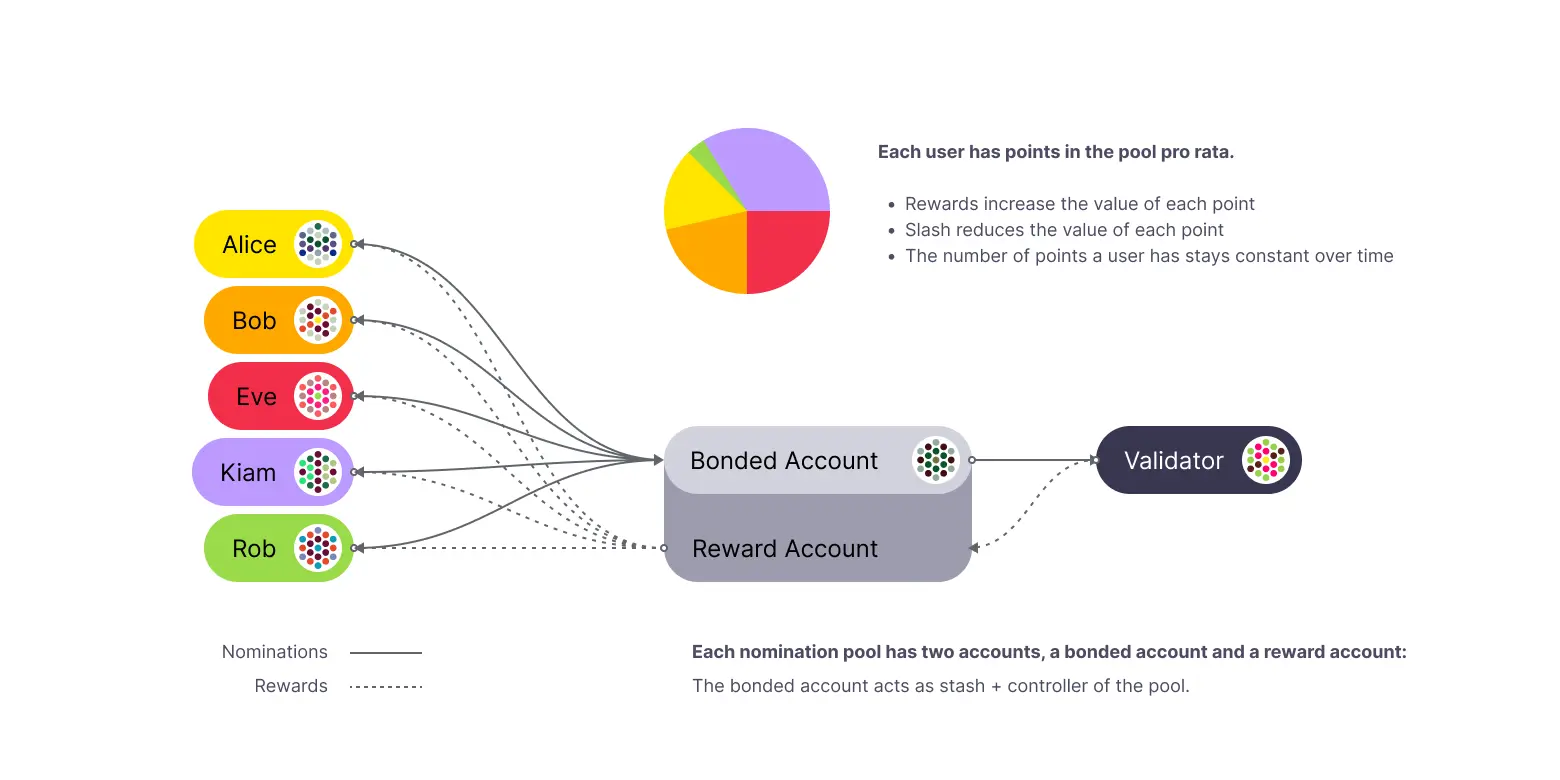

With nomination pools, multiple DOT holders can pool their tokens together and act as a single nominator, collectively backing a set of validators chosen by the pool creator with their combined stake.

Rewards are automatically split pro-rata among the members of the pool, and nomination pools do not currently take a commission. This means that pool members can currently expect the same rate of rewards for their stake as they would if participating in the system as a direct nominator.

To ensure economic incentives are aligned and network security is maintained, slashes are also applied proportionally to pool members who are actively bonded.

Joining a nomination pool

The simplest way to participate in nomination pools is through the Polkadot Staking Dashboard, the network’s new, user-friendly web application for staking. More advanced users can also participate via Polkadot-JS Apps.

Joining a nomination pool through the Staking Dashboard is as easy as connecting your account, selecting a pool, and signing a transaction to contribute your DOT to the pool. For a complete walkthrough on how to join a pool through the Polkadot Staking Dashboard, see the tutorial video walkthrough.

Note that you can only participate in a pool with a transferable balance and the amount you participate with is transferred from your account to the nomination pool. Those who have already bonded funds can bond additional funds or re-stake rewards. Currently, you can only belong to one pool at a time. Because the member funds are transferred from your account to the pool's account, any funds you nominate to a pool will not appear in your balance.

Additionally, voting for governance with pooled funds is not currently possible. In order to unstake, or simply switch from one pool to another, you’ll need to wait the 28-day unbonding period on Polkadot.

The stakes are infinitely better on Polkadot

Polkadot's native nomination pools are an important and valuable addition to the network. As a result of this update, NPoS becomes more scalable and provides a more user-friendly and inclusive way to stake on Polkadot, opening up staking to many more DOT holders.

Pools also offer new opportunities for validators. With nomination pools deployed, the number of DOT entering the staking system is likely to increase, and validators will have an incentive to ensure the inflow of tokens is directed towards them.

Join or open a nomination pool today via the Polkadot Staking Dashboard, or via Polkadot-JS Apps.

Read more about staking on the Polkadot website, orvisit the Polkadot Wiki for a more technical deep-dive on nomination pools. To keep up to date on the latest updates to Polkadot’s staking system, follow the staking system updates on the Polkadot blog.

*Staking rewards fluctuate based on network conditions. Historical rewards rates are not indicative of future rewards.

Interested in developing for or building on Polkadot? Get in touch for hands-on support.